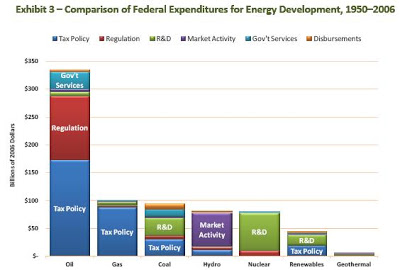

From a new Management Information Service analysis of US energy funding of all kinds from 1950-2006

Click on the images for a larger view.

Tax Policy

Tax policy includes special exemptions, allowances, deductions, credits, etc., related to the federal tax code.

Regulation

Two types of federal expenditures associated with regulation were identified:

1) gains realized by energy businesses when they are exempt from federal requirements that raise costs or limit prices, and 2) costs of federal regulation that are borne by the general budget and not covered by fees charged to the regulated industries.

An example of the first type of regulatory incentive comes from the oil industry, which has benefited from:

– exemption from price controls (during their existence) of oil produced from “stripper wells”

– the two‐tier price control system, which was enacted as an incentive for the production of “new” oil the higher‐than‐average rate of return allowed on oil pipelines.

– The higher‐than‐average rate of return allowed on oil pipelines.

Research and Development

This type of incentive includes federal funding for research, development and demonstration programs. Of the $725 billion in total federal spending on energy since 1950, research and development funding comprised about 19 percent ($136 billion).

Market Activity

This incentive includes direct federal government involvement in the marketplace. Through 2006, federal market activity totaled $72 billion (10 percent of all energy incentives). Most of this market activity was to the benefit of hydroelectric power and, to a much smaller extent, the oil industry. Market intervention incentives for hydroelectric energy include the prorated costs of federal construction and operation of dams and transmission facilities.

Government Services

This category refers to all services traditionally and historically provided by the federal government without direct charge. For example, U.S. government policy is to provide ports and inland waterways as free public highways.

Disbursements

This category involves direct financial subsidies such as grants. Since 1950, direct federal grants and subsidies have played a very small role in energy policy, accounting for $300 million, a negligible fraction of total incentives.

For nuclear energy, federal disbursements are negative, meaning the industry pays more than it receives in disbursements as a result of the contributions the industry makes to the Nuclear Waste Trust Fund.

Click on the images for a larger view.

FURTHER READING

This site has previously looked at energy costs with externalities.

Feed tariff support for renewable energy.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.