Global Wind Energy Council has published their global wind energy outlook for 2010. Greenpeace is one of the sponsors of the report. This report can be viewed as the maximum optimistic scenarios for wind energy.

There is minimal discussion in the report about increased transmission and energy storage issues with higher percentages of wind power. In general the issue is dismissed with the grid investments that have to be made should be made.

Supply chain issues and kite powered wind or other wind technology is not discussed in the report.

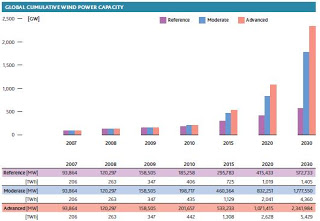

Market growth rates used in these scenarios are based on a mixture of historical figures, current policies and trends, new market development, discussions of future energy policy and other factors. While cumulative annual growth rates of more than 25% per year, as envisaged in the ‘Advanced’ scenario, are unusually high in most industries that manufacture heavy equipment, the wind industry has consistently experienced much higher growth. In fact, the global wind markets have grown by an average 28% per year in terms of total installed capacity during the last decade.

In the GWEO Advanced scenario, the average annual growth for cumulative installed capacity is assumed to start off at 27% in 2010, and then gradually decline to 9% by 2020. By 2030, they will have dropped to 4%. Growth rates as anticipated by the IEA in the Reference scenario start at 17% in 2010, drop to 3% by 2015, stabilising at that level. The growth rates for the Moderate scenario range from 26% in 2010 to 9% in 2020 and to 5% in 2030.

In the Reference (based on IEA outlook) scenario, wind power would produce 1,000 T Wh of electricity by 2020, a trebling from the estimated 350 T Wh produced by the 158.5 GW of wind capacity in 2009. Depending on the demand projection, this would cover between 4.5-4.8% of the world’s electricity needs, about the same share as is currently achieved in Europe. By 2030, 1,400 T Wh would account for 4.9% to 5.6%. Overall, the contribution of wind power to the global electricity supply would remain small.

Under the Moderate scenario, the situation would look considerably different. In 2020, wind energy would produce 2,000 T Wh, twice as much as under the Reference scenario, and this would meet 8.9%-9.5% of the world’s power demand – already a substantial contribution. By 2030, 4,300 T Wh would be produced by wind energy, taking the share up to 15%-17.5%, depending on how demand develops over the next two decades.

The Advanced scenario paints a picture in which wind power would become a central player in global power generation. By 2020, the world’s combined installed wind fleet would produce 2,600 T Wh of clean power, which would account for 11.5%-12.3% of global electricity supply. This would rise to 5,400 T Wh by 2030 and a share of 18.8%-21.8% – a fifth of the world’s power needs could thus be satisfied by wind power alone.

A wind turbine’s ‘capacity factor’ refers to the percentage of the nameplate capacity that a turbine installed in a particular location will deliver over the course of a year. This is primarily an assessment of the wind resource at a given site, but capacity factors are also affected by the efficiency of the turbine and its suitability for the particular location. For example, a 1 MW turbine operating at a 25% capacity factor will deliver 2,190 MWh of electricity in one year.

Capacity factors are also much higher at sea, where winds are stronger and more constant. The growing size of the offshore wind market, especially in Europe, will therefore contribute to an increase in the average. As a result, across all three scenarios, we assume that the average global capacity factor will increase to 28% by 2015 and then 30% by 2036. Although capacity factors will vary from region to region, we have assumed these same global averages for the regional scenarios as outlined below.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Featured articles

Ocean Floor Gold and Copper

Ocean Floor Mining Company

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.