IMF China Economic Outlook, Feb 6, 2012 (10 pages)

A storm emanating from Europe would hit China hard

* China’s growth rate would drop abruptly if the Euro area experiences a sharp recession

* But China has room for a countervailing fiscal response, and should use that space

* Unlike 2009–10, any stimulus should be executed through the budget rather than the banking system

A European depression would send China’s GDP growth down to 4% in 2012 but China could stimulate and get GDP growth back to 7% in 2012-2013.

However, a track record of fiscal discipline has given China ample room to respond to such an external shock. A sizable fiscal stimulus could mitigate, but not fully offset, the decline in its output. In particular, a front-loaded fiscal stimulus of around 3 percent of GDP spread out over 2012–13 would limit the growth decline to around 1 percent, cushioning the adverse effects on employment and people’s livelihoods.

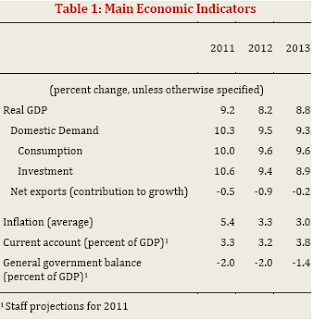

Without a major problem in Europe, the IMF expects China GDP growth to go back up to 8.8% in 2013

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.