Here is 16 page briefing from the Carnegie Endowment by Albert Kiedel on the economic rise of China

UPDATE: The British Telegraph has an interesting series of articles on life in China now

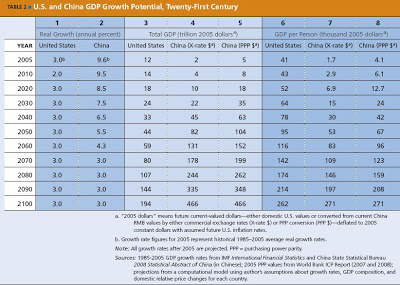

The very conservative projection described in the table above already underestimates China’s economy. It has China at $4 trillion on an exchange rate basis in 2010.

This site estimates that China is at that level in late 2008 (and already if Hong Kong and Macau are included which they should as part of China since 1997 and 1998).

As of July, 2008 :

China’s currency is now 6.85 yuan to 1 USD. China’s GDP is now $3.85 trillion. Including Hong Kong and Macau China has $4.2 trillion GDP.

Year GDP(yuan) GDP growth Yuan per USD China GDP China+HK/Ma US GDP

2007 24.66 11.9% 7.3 3.38 3.7 13.8

Jul08 26.3 6.85 3.83 4.2 Past Germany

Oct08 26.7 6.65 4.0 4.45

2008 27.3 10.2% 6.35 4.3 4.8 14.0

2009 30.1 9.8% 5.62 5.4 5.9 14.2 Pass Japan

2010 33.7 9.5% 5.11 6.6 7.1 14.6

2011 37.0 9.5% 4.64 8.0 8.5 15.0

2012 40.6 9.5% 4.26 9.5 10.0 15.4

2013 44.2 9.0% 3.91 11.3 11.8 15.9

2014 48.2 9.0% 3.72 13.0 13.5 16.4

2015 52.0 8.0% 3.54 14.7 15.2 16.9

2016 56.2 8.0% 3.53 16.7 17.2 17.4 Passing USA

2017 60.4 7.5% 3.38 18.8 19.4 17.9 Past USA

2018 64.2 7.0% 3.20 20.9 21.5 18.4

2019 69.2 7.0% 3.09 23.0 23.6 19.0

2020 74.0 7.0% 3.0 25.2 25.8 19.6

2021 78.4 6.0% 2.9 27.2 27.8 20.2

2022 83.1 6.0% 2.9 29.4 30.0 20.8

2023 87.3 5.0% 2.8 31.5 32.2 21.4

2024 91.7 5.0% 2.8 33.7 34.4 22.0

2025 96.3 5.0% 2.7 36.1 36.8 22.7

2026 101.1 5.0% 2.6 38.7 39.4 23.4

2027 106.1 5.0% 2.6 41.4 42.1 24.1

2028 111.4 5.0% 2.5 44.4 45.1 24.8

2029 117.0 5.0% 2.5 47.5 48.2 25.5

2030 122.8 5.0% 2.4 50.9 51.6 26.3 Close to double USA

Since last October interest rate differentials between dollars and yuan have reversed. The U.S. Federal Reserve aggressively lowered rates just as the Chinese central bank, the People’s Bank of China, was pushing up domestic rates to fight inflation. Currently, rates on the Chinese central bank’s one-year bills are about 170 basis points higher than comparable U.S. Treasuries.

This has created an arbitrage opportunity that local firms are exploiting on a massive scale, borrowing cheap dollars to substitute for more expensive borrowings in yuan and for local investments. A second factor driving this arbitrage is the wide-spread expectation that the government will either speed up the rise in the yuan’s crawling peg or implement a one-off revaluation.

FURTHER READING

Previous economic update on China

Highlights of the Carnegie Endowment economic rise of China

Other Keidel analysis of China

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.