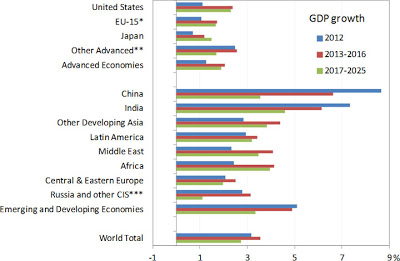

Until at least the middle of the next decade, global growth is likely to slow to approximately 3 percent per year on average rate somewhat below the average of the last two decades. A recovery in advanced economies will be more than offset by a gradual slowdown in emerging ones as they mature, with the net result that global growth will slow. But the biggest risk ahead for the global economy is not this slower overall growth in output but a slowdown in average output per capita, which will determine how fast living standards can be supported and raised.

* Global growth is projected to grow at 3.2 percent in 2012, then accelerate somewhat to 3.5 percent from 2013-2016, and then show a further slowdown to 2.7 percent from 2017-2025. At 3 percent, on average, global growth will still be somewhat higher than the period 1980-1995 but between half and a full percentage point below the growth rate from 1995-2008.

* Advanced economy growth is expected to slow down from an already meager 1.6 percent in 2011 to 1.3 percent in 2012. For 2013-2016, the outlook suggests some recovery in advanced economies, bringing these countries back to the pre-recession growth trend of a little more than 2 percent.

Medium-term (2013-2016) and long-term (2017-2025) projections are based on a growth accounting model, looking at the contributions of labor, capital and total factor productivity to growth. Growth in labor is approximated by the growth in working age population. Capital growth is derived from growth of working age population, and the past period performance in investment over GDP ratio, total factor productivity growth, capital deepening and depreciation. Total factor productivity growth is determined by the past period performance in TFP growth and labor productivity level.

The projected GDP growth, based on the growth accounting framework, is considered relative to measured trend growth of an economy. Our optimistic and pessimistic scenarios are based on the economy’s deviation from the trend growth and the growth rate needed to close the output gap.

The calculation of measures of regional and global GDP growth requires levels of GDP to weigh the growth rates of individual countries and regions by their size of GDP. The country and region GDP weights are current weights, which are the average for the beginning and the end of each period, and which are benchmarked on purchasing power parity (PPP)-adjusted GDP from Penn World Table 7.0.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.