China is expected to spend more than $3.9 trillion on installing 88 GW of new power stations every year between now and 2030 – and more than half of them will be hydropower plants according to Bloomberg New Energy Finance. China’s power capacity will more than double by 2030 and renewables including large hydro will account for more than half of new plants, eroding coal’s dominant share and attracting investment of $1.4 trillion. China’s power sector carbon emissions could be in decline by 2027.

By 2015, China’s hydro power installations are targeted to reach around 325 GW, and with a newly revised target of 430 GW (up from 380 GW) by 2020. This is adding hydro power at about 25 GW per year. The Three Gorges Dam produces 22 GW (80 TWh per year)

Bloomberg New Energy Finance analysed China’s power sector based on four separate scenarios — Traditional Territory, New Normal, Barrier Busting, and Barrier Busting with Carbon Price.

In the central scenario, dubbed ‘New Normal’, China’s total power generation capacity more than doubles by 2030, with renewables including large hydro contributing more than half of all new capacity additions.

This, together with an increase in gas-based generation, would drive the share of coal-fired power generation capacity down from 67% in 2012 to 44% in 2030. In absolute terms, however, even in this scenario, coal will continue to grow rapidly until 2022, adding on average 38GW per year – equal to three large coal plants every month. It will then grow at a much lower rate, installing on average only 10GW per year until 2030.

If China is able to reduce coal power to 44% of its energy mix that would be a little better than the share of coal power that the US had in 2008 before the surge in natural gas.

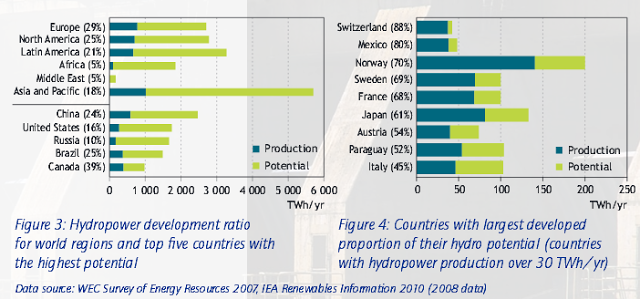

China currently has about 260 GW of hydro power producing about 900 TWh of electricity.

China has hydropower potential of about 2400 TWh.

44 GW of hydropower for 17 years seems to be beyond the hydro potential of China. The 800 TWh available in Siberia would seem to be needed as well

Due to the longevity of China’s coal industry, the country’s carbon emissions and atmospheric problems causing poor air quality will continue through the next 10 to 15 years, and could take many more before any considerable beneficial effects are seen.

The remaining three categories are described as follows;

* Traditional Territory — which sees a heavier reliance on coal and fossil fuels

* Barrier Busting — in which barriers to the adoption of clean technologies are systematically eliminated by policy-makers

* Barrier Busting with Carbon Price — which includes the above category and then includes a carbon price.

Bloomberg New Energy Finance leveraged its proprietary energy models, data and knowledge from its China-based team of experts to come up with the four scenarios for China’s power sector until 2030. The other three scenarios examined were ‘Traditional Territory’ (which sees a heavier reliance on coal and fossil fuels), ‘Barrier Busting’ (in which barriers to the adoption of clean technologies are systematically eliminated by policy-makers), and ‘Barrier Busting with Carbon Price’.

To complete the most aggressive scenario, combining the Barrier Busting scenario with an emissions trading scheme (ETS) starting in 2017, Bloomberg New Energy Finance’s team produced what it believes is the world’s first forecast of a Chinese carbon price, based on stated national goals for emission abatement. An average carbon price of CNY 99/tCO2e ($16/tCO2e) will result in 23% fewer new coal plants being built compared to the New Normal scenario. The difference would be made up by more renewables and natural gas. The sector’s carbon peak would arrive four years sooner as a result, in 2023.

Milo Sjardin, head of Asia Pacific at Bloomberg New Energy Finance, said: “The wide range of outcomes in our scenarios demonstrate the extreme uncertainty facing China’s energy sector. The future depends on a number of big questions, questions on which one can still only speculate: the cost at which China may be able to extract its shale gas reserves, the potential impact on fracking and thermal generation of water constraints; and potential accelerations in climate and environmental policy, including a potential price on carbon.”

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.