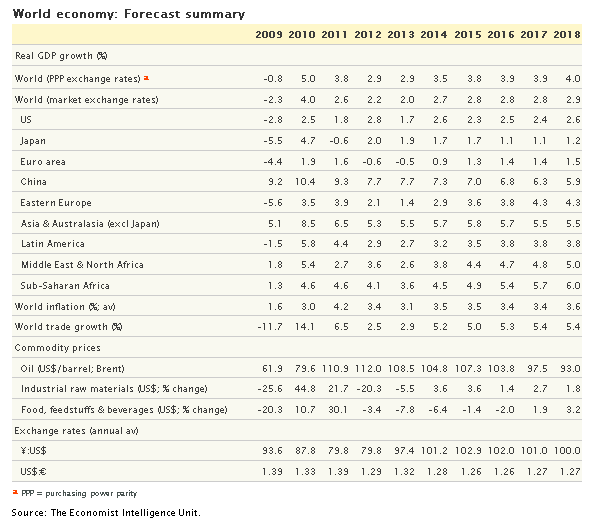

The Economist Intelligence Unit has forecasted the world economy and countries and regions out to 2018. The expectation is for world GDP growth to be about 3.6-4.0% per year. This is about 80% of the 4.5-5.2% GDP growth that was seen in pre-financial crisis period of 2003-2006.

If this is correct the world economy will be better than the 2012-2013 period.

The outlook for many emerging markets is balanced between the positives of improving growth prospects in the rich world—which will boost trade with developing economies—and the need for difficult structural adjustments after years of policy neglect. In Asia, concerns about a sharp Chinese slowdown, which had briefly loomed large in the middle of this year, have retreated following strong third-quarter GDP data. This has prompted an upward revision to our growth estimate for China in 2013, to 7.7%. We still expect Chinese growth to slow in 2014, to about 7.3%, as the authorities tighten credit and as a secular shift towards more sustainable rates of economic growth continues. India’s economy continues to struggle. GDP growth in the April-June quarter was the slowest since 2009, although the worst is probably now over. We expect growth to accelerate to 5% in fiscal year 2013/14 and 6% the following year, aided by more active policymaking. But the country still faces abundant problems—not least pressure on the rupee as the prospect of QE withdrawal in the US causes the dollar to strengthen.

In Sub-Saharan Africa, regional GDP growth will pick up from 3.6% in 2013 to 4.5% in 2014. Growth will accelerate further in subsequent years, to about 6% by 2018, as investment in mining and natural resources pays dividends and as the growth of the lower middle classes boosts consumer markets.

The Russian economy will remain stagnant in the first half of 2014 but growth should pick up thereafter as inflation eases and interest rates are cut. Growth in the transition region as a whole will pick up from 1.4% in 2013 to almost 3% in 2014, accelerating further in 2015-18.

The outlook for the US economy is, ironically, better after the October government shutdown and debt crisis than before. A strong third-quarter GDP report—the economy expanded by 2.8% at an annual rate, the fastest pace in a year—and a suddenly improving labour market reinforce our view that the economy is picking up steam. Because of the government shutdown and crisis over the federal debt ceiling, the reasonably buoyant third-quarter results will not carry over into the fourth quarter. But the economy, on balance, seems to be navigating most of the obstacles in its path. We have revised our estimate for real GDP growth in 2013 up to 1.7% from 1.6% previously. GDP growth will accelerate to about 2.6% in 2014.

The euro zone’s economic recovery remains patchy. The effects of the debt crisis remain a serious drag on economic growth, as was illustrated by the mixed economic data for the third quarter of 2013. Real GDP growth slowed to 0.1% quarter on quarter, from 0.3% in April-June. That said, the data still generally support the view that the recovery—while tepid—is broadening. The recent return to economic growth, following six consecutive quarters of contraction, will have a positive effect on household and business confidence. We maintain our forecast that the euro zone will contract by 0.5% in 2013 and grow by 0.9% in 2014.

Japan’s economic recovery continues, although not without setbacks. It is being aided by the reflationary policy agenda of the prime minister, Shinzo Abe. However, there remains uncertainty as to whether the government can build on the recovery—and push through structural reforms in the face of vested interests—once the initial phases of its economic revival programme have passed

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.