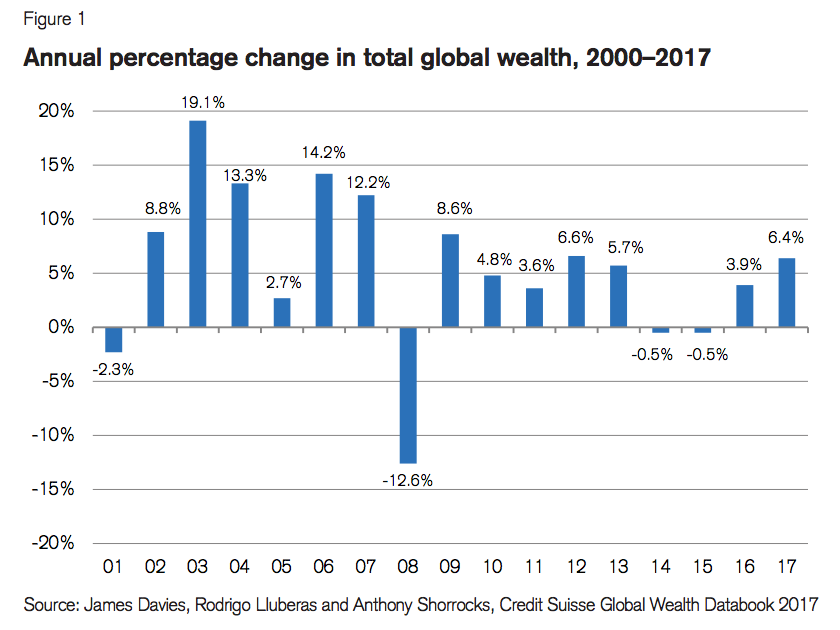

Credit Suisse has its latest Global Wealth Report. From mid-2016 to mid-2017, total global wealth rose at a rate of 6.4%, the fastest pace since 2012 and reached USD 280 trillion, a gain of USD 16.7 trillion. This reflected widespread gains in equity markets matched by similar rises in non-financial assets, which moved above the pre-crisis year 2007’s level for the first time this year. Wealth growth also outpaced population growth, so that global mean wealth per adult grew by 4.9% and reached a new record high of USD 56,540 per adult.

Global wealth should increase from 280 trillion now to $341 trillion in 2022. If the 21% per year increase every 5 years was maintained then it would take until 2050 for world wealth to reach 1 quadrillion. By 2040 there should be about 100 million millionaires. Up from 37.1 million today.

* 1% of the world population now holds over 50% of all wealth

* the US added $8.5 trillion in stock wealth

* Wealth growth has been weaker and more fragile since the crisis of 2008

* In every area of the world except China from 2007 to 2016 median wealth declined.

* Median wealth (where 50 percent of people have less and 50 percent have more) for the world was USD1837 in 2000 (in constant dollars) increased to 4220 in 2007 and has been at about 3700 since the crisis in 2008. In 2017 it is at $3582.

* China’s median wealth ($6689) is almost double the global media. The US is at $55879 median. Japan and many European countries are at about $120,000 median. Switzerland has a median of $229,000.

* Africa is at $432 now, which is less than half of $1024 in 2007 and less than 2000

* There are now 37.1 million millionaires in the world up from 13.2 million in 2000. they have $128 trillion in total

* Almost half of the millionaires are in North America (46%)

* There are 391 million people (7.9%) with 100,000 to 1 million in net worth. (Europe has most of this category, then Asia Pacific [Japan], then North America]

* There are 1.054 billion people (21.3%) with 10,000 to 100,000 in net worth. Chinese are 35% of this category.

* since 2000, 2.7 million millionaires are from emerging economies

Millenials have had bad luck by coming of age in a bad economic time. Only the hardest working and those with desirable tech skills will be able to overcome the higher unemployment, lower wages and higher debt.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Are the dollars quoted in the report nominal or are they adjusted for purchasing power?

I read the introduction and the footnotes but did not see it mentioned.

A little disingenuous misquoting and rewriting the original author on this:

Millenials have had bad luck by coming of age in a bad economic time. Only the hardest working and those with desirable tech skills will be able to overcome the higher unemployment, lower wages and higher debt.

This is actually what was said:

“Looking at the bottom of the wealth distribution, 3.5 billion people—corresponding to 70% of all adults in the world—own less than $10,000. Those with low wealth tend to be disproportionately found among the younger age groups, who have had little chance to accumulate assets, but we find that millennials face particularly challenging circumstances compared to other generations,” they wrote.

“Essentially, millennials are more likely to be unemployed or earning less, priced out of the housing , and unable to get a pension. Baby boomers have most of the wealth and the housing, so “millennials are doing less well than their parents at the same age.”

I think you glossed over the original bullet point in the title by the Credit-Suisse author:

1% of the population now holds over 50% of all wealth.

Capitalism rocks

Capitalism rocks.