Private companies in China tend to invest in the USA, UK, Switzerland and Australia. They are acquiring hotels, entertainment firms and real estate. There is also some M and A activity for buying profitable businesses. Investments in developed countries are more profitable.

Average 20-year returns (1995 to 2015) in the commercial real estate slightly outperform the S&P 500 Index, running at around 9.5%. Residential and diversified real estate investments do a bit better, averaging 10.6%. Real estate investment trusts (REITS) perform best, with an average annual return of 11.8%. The S&P 500 Index’s average annual return over the past 20 years was approximately 8.6%.

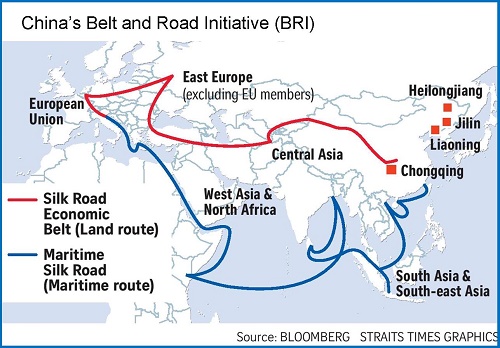

BRI investment was $138 billion and construction was $202 billion. China was investing and constructing in Asia prior to the BRI projects.

According to some estimates, Piraeus may become the largest port of the Mediterranean region by 2020, but the purchase of the container port may be dwarfed by the planned investments and developments. China will develop ports on Sri Lanka, in Pakistan, Bangladesh and Kenya – all being parts of the project. The expansion of the Suez Canal will also greatly facilitate trade in the region. The port of Piraeus will also fit in this system, and is extremely important because it would connect the maritime section of the Silk Road with the continental one. The Chinese already expressed their intention to invest in the Greek state railways as well. China has invested nearly US$7 billion into the development of the port of Athens, and $1 billion into the construction and operating of the airport on Crete. Greece-bound tourism has also increased: 70% more versus 100,000 Chinese tourists visited the country in 2014.

The countries with new ports and rail and other infrastructure do better. China as a whole gets more trade and influence. It is difficult to calculate the returns to the investing SOE.

China is investing at an average annual rate of $50 billion year and constructing at $60 billion per year. This is an increase from an average of $19 billion per year in investment and $38 billion per year in construction from 2010-2013.

At this pace in 2023 or 2024 the combined BRI investment and construction will surpass $1 trillion.

70% of the investments and 95% of the construction has been by State Owned Enterprises (SOE).

AEI is forecasting that China will maintain the average annual rate of $50 billion year in investment and $60 billion per year in construction and will reach $1 trillion around 2024 and $2 trillion around 2033.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Hello

See how to make a steady living incomes of $100 daily on virta stock trading without you risking your money and your investment visit the website here www virtatrade com/index.php for more details