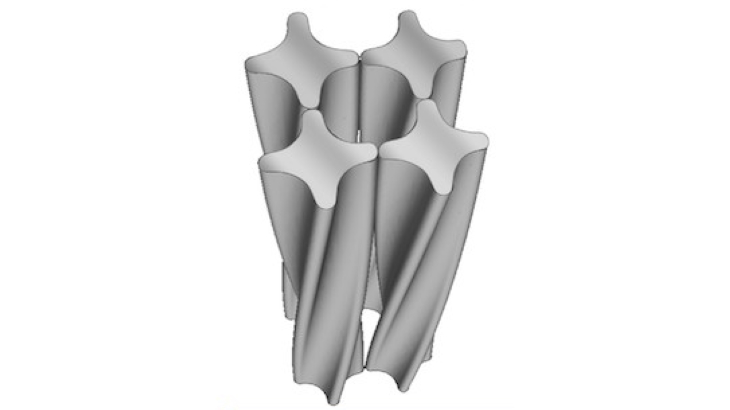

Lightbridge Corporation and Enfission, LLC have demonstrated the manufacturing process and fabrication of Lightbridge Fuel surrogate rods in a length that could be usable in NuScale Power’s small modular reactors (SMR).

The demonstration included the production of several coextruded rods using an internally developed and patented coextrusion process, Lightbridge said. The fuel rod design is expected to increase core performance, extend core life, lessen the number of refueling outages, and offer reduced levelized cost of electricity.

The fuel rods, which are 6 feet (1.8 metres) in length were coextruded from billets contained in a zirconium canister and resulted in a bonded cladding surrounding the surrogate fuel material core. The surrogate materials were designed to simulate the flow stresses, including temperatures and extrusion pressures, expected in the manufacture of the Lightbridge Fuel rods using a uranium-zirconium alloy.

Lightbridge Corporation and Enfission President and CEO Seth Grae said the rods were produced in the USA, using the companies’ patented technology and process. The successful demonstration marked a major milestone for Lightbridge and Enfission, representing “first reduction to practice” for the proprietary manufacturing process and confirming the feasibility of fabricating rods to 6 feet in length, he said. “We are now moving rapidly towards a similar demonstration of full-length (i.e. 12 feet) coextruded rods for the existing US fleet of large commercial nuclear power plants and we look forward to providing further updates,” he said.

Demonstration of the coextrusion manufacturing process follows a Memorandum of Understanding between NuScale and Enfission in May 2019, under which the parties agreed to collaborate on the development of research and testing programs to explore the application of the Lightbridge Fuel technology in NuScale’s SMR design.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

I updated this to use 13.5% enrichment as you said. If I use 9% enrichment, then the Lightbridge costs $140k more per assembly in fuel cost. If you want to paste in excel, I used ‘|’ pipe as delimiter.

assume

$/lb U3O8|$26

$/lb conv|$9.08

$/SWU|$80

U3O8/UF6|1.185

fuel|PWR|LightBridge|Original LB calc

feed|0.71%|0.71%|0.71%

product|4.50%|13.50%|9.00%

tails|0.25%|0.25%|0.25%

value function|4.87|4.87|4.87

value function|2.78|1.36|1.90

value function|5.96|5.96|5.96

kg feed|4203.8|7287.5|4812.5

$ feed|$285,326|$494,626|$326,640

$ conversion|$84,076|$145,750|$96,250

$ SWU|$250,401|$541,509|$336,914

kg product/asy|455|253|253

kg tails|3749|7035|4560

SWU|3130|6769|4211

lb U3O8 feed|10,974.06|19,024.07|12,563.06

$/assembly|$619,802|$1,181,885|$759,803

If an 18-month reload for 3460MWt PWR needs 80 oxide fuel assemblies (typical), then fuel cost (neglecting manufacturing) is $49.6M. If we give great benefit of doubt that Lightbridge will allow the loading of 69 fuel assemblies in equilibrium taking advantage of increased surface area allowing higher peaking, then the LB reload costs $81.6M. It doesn’t break even until reducing LB reload to 42 fuel assemblies. It would take some effort to explain why that is not possible WRT thermal margins. Your reference says that it takes 13% enrichment to equal the fissile load of 5% enriched UO2 and 20% enrichment to equal fissile load of 7.2% . So, if I need to load 80 assemblies at 5% then I need to load 80 LB at 13% – 0 benefit.

Thank you. I always learn something from your contributions.

Somehow I had the impression that Lightbridge Fuel leaves a larger fraction of the core for water. Does that enable an uprate, especially for instance in natural circulation systems like the proposed BWRX-300?

Owning Lightbridge stock has cost me some money over the years…

From what I can gather NuScale is talking about fine grained control rod adjustments to follow load, not the coarse grained “shut the reactor down” approach that I am talking about.

I’m thinking more for reduced weekend power consumption that they could just shut a reactor or two down Friday evening and start them up Monday morning. Enough down time for 6 Xe half lives.

“60 MW intervals”

I can see why you believe it would be as simple as tripping units as needed, because plant operations is rarely discussed… its always fuel cycle this, burning waste that, LCOE of $6/watt, etc., sunshine, etc.. More reasonable, but still probably not the way it would be done, would be to take individual reactors and associated steam plant/turbines down to slightly above the power at which they sync the generator and keep everything hot and min flow at perhaps 12MWe output.

No reason to drop the neutron population down through 20 decades into source range and scratch start everything when the demand rebounds….

My original comment about ramping metallic vs ceramic fuel just hints that the process of load following is a bit more complex than many folks imagine.

Currently with NuScale you could do load following in 60MW intervals. Just stage weekend and evening downtime across the reactors at a plant. The plant itself is load following in 8% intervals. Multiple plants could provide even better control over following power consumption.

Honestly, this fuel would eliminate much difficulty with load following. There would be no pellet-cladding interaction, cladding creep-down, hoop stress from pellet on cladding, stress concentration from chipped pellets, etc. You could take this fuel up and down in power as fast as the rankine plant could handle it, and you could manage the YYUGE xenon fission product transient with continuous control rod positioning, which we don’t do now in BWR because pellet-cladding interaction… this is the big benefit of this metallic fuel as I see it, and also why it is well suited for marine use. Could be worth a premium fuel costs if we ever go full nuclear baseload and have dedicated peakers.

That would be a reasonable assumption, but then why not say so?

I hate popularized accounts of technical matters.

I was assuming the ‘surrogate’ was garbled communication and that natural uranium was used.

“The surrogate materials were designed to simulate the flow stresses, including temperatures and extrusion pressures, expected in the manufacture of the Lightbridge Fuel rods using a uranium-zirconium alloy.”

I’d like to see a bit more information on these “surrogate materials”. After all, there’s no particular obstacle to just doing their extrusion testing with uranium-zirconium alloy; All they have to do is use depleted uranium, which would behave identically in all respects except sustaining a nuclear chain reaction.

$27.3 billion and growing for Vogtle

https://www.energyandpolicy.org/price-tag-for-plant-vogtle-jumps-higher-total-project-now-at-27-3-billion/

No I completely get the point. My point is that they didn’t even provide a single number that would help assess the cost/benefit of their fuel.

You’re failing to recognize my basic point here. If loading 12-20% enriched uranium was economical for commercial power reactors, we would still load UO2 because it has twice the uranium atom density and therefore twice the energy for a given enrichment.

Truer words… truer words.

Aah but once you reference the power uprate made possible by this fuel…

oh wait it isn’t in the press release. Well shoot.

For Nuscale to have a LOCA you would need to drain the entire pool. A break in the reactor vessel means that the water in the reactor fills the space between the inner reactor vessel wall and the outer wall. For LOCA you would need to evaporate the fuel in the entire common pool (1 month time) and rupture both the inner and outer walls of the RPV so that the water inside could spill out.

Then you’d have to deal with air cooling (albeit not the best air cooling).

Boy it would sure be neat to have some numbers for how much longer a NuScale reactor could run between refueling with lightbridge fuel or to know what kind of power uprate is possible (and if it would require different steam generators).

If you can increase power output by 15% then NuScale became much more cost competitive.

Vogtle expansion project for 2.2GW is going to exceed $20B when complete per recent estimates – so that is closer to $9B/GW.

We don’t know what the FOAK NuScale plant is going to cost. It is of much interest, no doubt. We should double whatever the most credible estimate.

I love when people talk about LCOE and all that jazz. It’s a good way to shut most people out of the conversation. Determination of LCOE is a speculative art.

The feed, conversion, SWU costs of NuScale are 143% of a “normal size” LWR just based on discharge burn-up. Additionally, there is a ~$200K fabrication cost for each fuel assembly, and guess what? The NuScale fuel is exactly half the height of “normal size” so that makes NuScale’s fabrication costs double per ton of fuel. Perhaps there will be a slight price break for purchasing fewer linear feet of tube/ea, but that $200K/ea is mostly overhead. Sharpening the pencil for you right there just brought NuScale’s fuel costs up to 153% of “normal size” LWR – and THAT IS PAID ALL DAY LONG for 60-year life of plant. More spent fuel for ultimate disposal too…. 143% more of that.

So, NuScale is gonna be many things, but it won’t be cheap to operate. Looking like 30 people in the control room at the moment…. So, yeah. Throw in some Lightbridge while yer at it.

I don’t do LCOE, but I DO fuel cost calculations FOR A LIVING. NuScale is the Ford F350 of nuclear fuel economy – only to be outdone by most of the other conceptual NBF reactors.

Lightbridge uses 13.5% enrichment vs 4.95% for conventional LWR fuel in their comparison:

https://ltbridge.com/wp-content/uploads/2018/01/Lightbridge-Rev-16.1.pdf

Plugging this into UxC´s fuel quantity and cost calculator (https://www.uxc.com/p/tools/FuelCalculator.aspx )

gives about $ 3715 /kg vs. $ 1313 /kg eU at default values for feed, conversion and enrichment.

But unless I miss something (I sometimes do) Lightbridge will need only 4.95/13.5 as much eU for the same energy compared to a conventional LWR, so their equivalent fuel cost would be $ 1362 /kg, amounting to a difference of something like .003ct/kWh.

So I´d be interested to see where your $ 100,000 per assembly figure comes from.

Nuscale’s first unit at 684MWe is expected to cost $3 billion, giving $4.4 billion/GW, The AP-1000 is 1,117MW and the cost for the two units at Vogtle is expected to be $14B, for a cost of $6.3 billion/GW. So the capital cost of the AP-1000 is 43% higher than Nuscale’s, basically matching Nuscale’s 40% higher fuel cost.

With fuel being 30% of the LCOE, and capital being more than that, I’m going to go out on a limb and say Nuscale will deliver cheaper energy than the AP-1000.

Fuel is $7.5/MW-hr at a big LWR. Wholesale electric rates in my area on the PJM grid are about $24/MW-hr year average and dip to $18/MW-hr during pleasant months like October and peak at ~$40/MW-hr in January, February.

Would you care to revise that thumb-rule? It is out of date. Seems that nuclear fuel costs are on the order of 25-35% of the wholesale cost of power.

Note that a home owner gets $200/MW-hr in the form of Solar Renewable Energy Credits (SREC) for their rooftop solar in NJ. This gives NJ subsidized solar a return better than the S&P 500.

https://www.srectrade.com/markets/rps/srec/new_jersey

Bottom line…. there is no incentive to significantly increase fuel costs, like there is no reason to put aviation gas in your minivan.

But fuel is a relatively minor cost. If Nuscale’s capital costs are significantly lower, that could make up for it. (I don’t know whether they are.)

The bulk fuel temperature is likely on the order of 100C above coolant temperature, so there is only a fraction of the 6 full power seconds of stored energy we see in UO2 at the same power and 600C average fuel temperature. So, in large break with reflood, peak temp stays low, low, low. Of course it becomes beyond design basis if you don’t reflood, and all is lost – melt, fire, hydrogen, the works. They’ve ‘published’ believable LOCA ‘results’ here (less BOOM!):

https://ltbridge.com/fuel-technology/metallic-fuel-technology/

The detractor for this fuel remains the need to enrich the U fraction (50% Zr 50% U) to 10% to equal energy in UO2 at 5% enrichment. Back of napkin calculations show at least $100,000 additional fuel costs (feed, conversion, SWU) per assembly JUST TO EQUAL energy content of 5% enriched UO2.

It’s not going to be adopted. Nuscale’s fuel costs are already 140% of typical just based on low discharge exposure (35GWD/TU vs. 49 for current LWR fleet). Lightbridge has no agreement to load test rods in any reactor today, unlike various ‘ATF’ products like uranium-silicon pellets currently being irradiated at Exelon’s Byron station. If they want to test this fuel they need to make a rod without the helix, so that it would fit in a normal pwr assembly and not introduce hydraulic complications of concern for licensing.

Wow! They demonstrated fabricating what they said they could fabricate, and they did it on US soil!

Note: similar fuel was used in early Russian submarine reactors – like late 1950s.

Page 34: https://inis.iaea.org/collection/NCLCollectionStore/_Public/37/064/37064917.pdf?r=1&r=1

https://seekingalpha.com/article/3540956-light-end-tunnel-lightbridge

Awesome how they NEVER mention the Russian connection. That is definitely a marketing choice.

I wonder how that alloy will pass the loss of coolant test. It is not just the good old zirconium-steam reacton (makes hydrogen and goes BOOM! as in Fukushima), but also much lower melting point of metal fuel.