Solvency is a concern for non-Tesla car companies. The Z-score formula for predicting bankruptcy was published in 1968 by Edward I. Altman, who was, at the time, an Assistant Professor of Finance at New York University. The formula may be used to predict the probability that a firm will go into bankruptcy within two years.

The Z-score has been found to correlate with bankruptcy 70-90% of the time. It has been shown that manufacturing companies that go bankrupt have bad Z-scores in the years prior to bankruptcy. However, the prediction that companies with bad z-scores will go bankrupt is less clear.

The vast majority of car makers other than Tesla and some Asian car makers have z-scores that are in the danger zone. Bailouts and bankruptcies are a regular occurrence.

VW, Ford and BMW are financially even weaker than Daimler and GM on the Z-score. Model Y going to 2 million per year by 2023 hurts BMW and VW a lot. If Ford spends a lot on F150 Lightning and sales decline after an initial surge, and next year Cybertruck starts to hurt ICE trucks while Ford gets more losses from ICE declines and Lightning losses. Many more car startups (Nikola and others) will implode.

Nextbigfuture prediction that BMW, VW and Ford will need big bailouts and restructuring support within 4 years.

Macroaxis does give probability of distress. The Probability of Bankruptcy SHOULD NOT be confused with the actual chance of a company to file for chapter 7, 11, 12, or 13 bankruptcy protection. Macroaxis simply defines Financial Distress as an operational condition where a company is having difficulty meeting its current financial obligations towards its creditors or delivering on the expectations of its investors. Macroaxis derives these conditions daily from both public financial statements as well as analysis of stock prices reacting to market conditions or economic downturns, including short-term and long-term historical volatility. Other factors taken into account include analysis of liquidity, revenue patterns, R&D expenses, and commitments, as well as public headlines and social sentiment.

Tesla less than 1% probability of distress within 2 years

Volkswagen has a 73% chance of financial distress within 2 years

Daimler 49% probability of distress within 2 years

Ford 49% probability of distress within 2 years

ford 48%, GM 38%, BMW 49%, Hyundai 44%, Honda 49%, Toyota 45%

Nissan, Renault are coming out of reorganizations.

Volkswagen ID4 and ID3 sales have been underwhelming in 2021. VW is missing its ID4 and ID3 sales targets.

The legacy car companies have weak balance sheets and must spend tens of billions of dollars to transition to electric vehicles over the next decade. It is not certain that they can master making compelling and competitive electric cars.

All car companies will have to get the supply chain for new batteries at very large scale.

Suppose the Ford F150 Lightning is a success. Current Ford plans are to be able to build about 160,000 per year in 2026. Ford is targeting annual production of more than 80,000 in 2024, up from its initial target of more than 40,000. Sales of the F-150 Lightning will start in spring 2022. They plan to build 15,000 electric trucks in 2022 and 55,000 in 2023. A second-generation F-150 Lightning is scheduled for late 2025. Ford hopes to build and sell 160,000 electric trucks a year.

The F150 Lightning has 120,000 reservations and the Tesla cybertruck has over 1.5 million reservations.

Here's a comparison of the relative financial strength of several major international automakers.

(higher is better) 👀$TSLA pic.twitter.com/ejdc4X7F5c— James Stephenson (@ICannot_Enough) August 23, 2021

History of Auto Bankruptcies and Bailouts

Bailouts, bankruptcies and government support is standard for the car industry. The bailouts and aid to corporations is happening now and has been happening a lot historically.

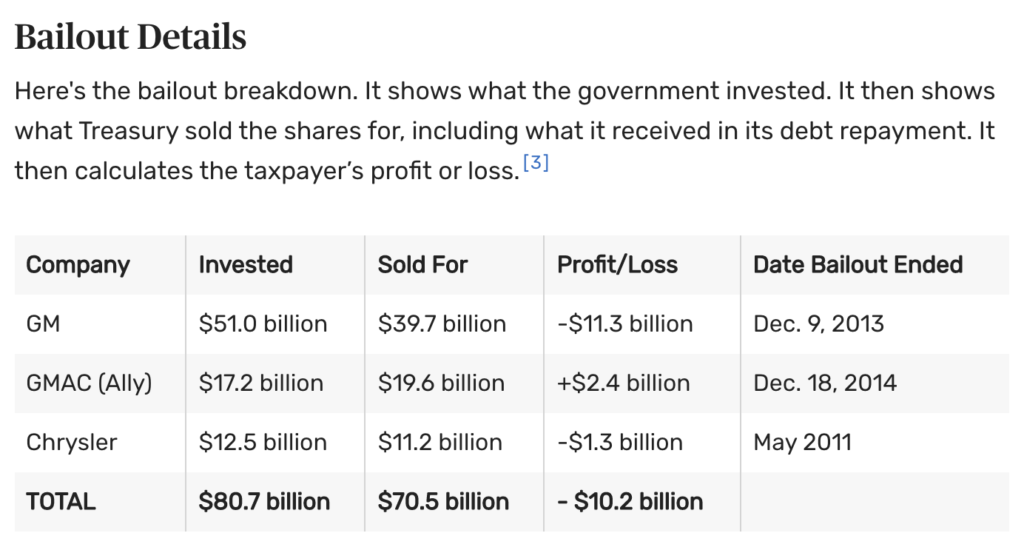

Chrysler and GM had bailouts from 2008-2014.

The Fed is also buying corporate bond ETFs as part of this $750 billion emergency lending program to buy corporate debt.

Toyota, Daimler, Volkswagen, Ford, GM and BMW are among the top companies getting interest rate support with bond purchases. Each got about $5-8 billion in bond purchase support.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Tesla is going to take over Amazon, Microsoft, Nokia, maybe even Samsung in year 2030. It will be Tesla and Apple are the only huge companies, Walmart long gone, they made a deal with Samsung, Amazon went bankrupt but saved by Tesla because that was the year they released the first Tesla mobile phone which beat the all time record of Apples Iphone 6 (biggest selling smartphone). Tesla and Apple will battle it out until the next Techs vs. Humans war will happen in the year 2035. It will kill and wipe humanity and only about 30% of humans will be left. They turn us into slaves (the robots do), and Im dead serious. Im a time traveler who was born in 1982 but turned a “traveler” (one of the few selected humans left to become one) in 2028. It’s a long story, I’ve traveled way as far back as Roosevelt years cuz I’m a huge fan of Ele myself. I got to meet her, we can’t change anythign that’s happened in the past, all we can do is re-live each and every moment. We can save someone who is dying or have died in accidents, Nikola tried that but killed him.

Sounds like it is going to hurt LG a lot more.

For that use case you will be better off with ICE, at least for the next 10 years.

Also, the cost of hydrogen per mile of range is substantially higher than the cost of electricity per mile of range.

But if you reduce their assets by their debts, does the remainder support their market cap?

One of these isn't like the others.

Debts are irrelevant, if you can manage it or can dispose of it if you cant manage it.

Robotaxi Teslas on urban streets at speeds no more than 35 mph should be demonstrably safer within 5 years. E.g. they'll brake and swerve a lot sooner to avoid collisions – nearly half the braking distance for human driven cars at those speeds is driver reaction time.

I'd guess that a year or two from now Tesla could show a robot walking around and avoiding people that step in front of them. That'd mostly replicate work already done in the industry.

And if I'm correct that a big direction for Tesla robots will be teleoperation (again, because Mars), they may have that working within a year or two more. Sooner if they do this work in parallel with getting the robot to stand and walk. A robot under human direction could do things no regular robot will be doing for a decade at least.

No, not just a spandex suit. They also had 2 very good powerpoint slides that even showed how many motors it'll have!

And that spandex danced at least as well as the Boston Dynamics robots, IMO.

Because of the number of employees and of the prestige, governments will interfere with the bankruptcy of the car companies.

I assure you that the marginal cost of a Tesla roadster does not approach zero. It's hardware, not software.

I'm at a bit of a loss how you go bankrupt with a decent cash flow, and more cash on hand than debt.

Throw a genset and a big tank of diesel in the back of the pickup?

Operator inputs can be done quite well with just video cameras aimed at the operator and some good software to precisely track the operator's movements. This is already fairly common practice, eg. for VR.

But without extremely good haptic and prioperceptive and other sensory feedback, it'd be impossible to directly control a walking humanoid robot. (That could be where Neurolink eventually comes in.) However, the robot can just take the human's movements as 'directions', which it does its best to mimic while remaining balanced.

I expect Tesla will use simulation to start training the robots – in particular simple stuff like learning to walk, run, reach, etc. Do that in a good physics simulator, to minimize how long the robot spends falling down in reality. But eventually the robot has to train in the real world, and it will need to be guided when doing that learning.

I seem to recall that "the last time GM went bankrupt", they permanently killed off about half their brands.

They can only pull that trick a few times.

Well, this is NOT going to help GM any.

https://www.wired.com/story/gm-recalls-every-chevy-bolt-ever-over-faulty-battery-fire-risk/

Toyota keeps doubling down on fuel cell. That is clearly already lost. The whole point was for more range. But range is not really an issue with electric or at least it won't be in a just a couple years.

Fuel cell will never be cheap…way too many parts. And those extra parts and tanks leave very little cargo room. Not much crumple space either.

Watch this to see just how much stuff they cram into this car: https://www.youtube.com/watch?v=N-hY7J7DQoU

So, say in 4 years I need a pickup to tow a decent-sized camper across North America for a year or two, especially to places a bit off the beaten track. Right now, a Ford 250 would be a clear winner. What am I doing in 4 years? Will electric pickups really be ready for something like that?

Assuming the government's heavy subsidization of Tesla through the regulatory credit system hasn't made it too big to fail, my money would be on Tesla going bankrupt first.

The only thing keeping Tesla afloat is the stock price, which is outrageously inflated. Despite all their big talk about gigafactories, they don't produce very many cars, and the cars they do manufacture have a littany of quality issues (e.g. the whompy wheels suspension problem, the battery fires, the panel alignment problems, the "autopilot" system repeatedly crashing people into stationary vehicles, etc.). A lot of these quality problems likely arise from the issues Tesla has had at its factories, including having to assemble cars in makeshift tents by hand due to problems with the factory, tens of millions of dollars in factory materials going missing from Freemont, an exorbitant number of OSHA violatons at Tesla's factories, etc.

Then, factor in all of the vaporware that Musk hypes to artificially pump the stock price: the tesla bot, the tesla semi, the cybertruck (so far), the roofing shingle solar panels, actual level 5 autonomy (robo-taxis), battery swap, etc. You can't endlessly inflate a stock's value on cheap hype and half-baked mock ups; the bottom will inevitably fall out.

Between Tesla's stringy, overpriced products, poor production rate, chaotic corporate structure, misleading marketing campaigns, and poor labor practices, they are undeniably volitile.

That would actually be an interesting development, except that they would need to develop some interface to allow the remote worker to control all the joints of the robot at once. Perhaps if Neuralink pans out?

At the end of the day, I don't think they will go this route. They will probably set up simulated worlds like the ones which they talked about in relation to FSD cars and train specific skills like balancing trays, using hammers, etc. Then train the bot AIs with these clips.

I don't think the type of robot they propose is that far off. I believe Boston Dynamics will have robots of similar capability by the end of this decade.

I live in Texas in the U S. and I've even a few Mach-Es on the highway and downtown, which is more than I expected right now (mostly because I've been a total hermit and not followed release dates).

I don't think many other car companies necessarily will go bankrupt if they can keep up with the coming change from fossil fuels to electric (though this depends on how quick that chsnge comes).

Thinking a bit more about Tesla robot…

One potential difference between Tesla cars and Tesla robot is that a bunch of Tesla cars are driven by humans, creating a huge database to review and learn from.

So what if Tesla will take a similar route for the robots, creating a remote worker service. A robot is delivered to a work site and a human connects to it to start working through it.

Benefits for the human are similar to that of working for Uber – set your own hours, work from home, no commute time – you transition near instantly from one job to the next as robots are pre-delivered. An app takes care of matching workers to skill requirements.

As the robots learn to do sub-tasks of some jobs (e.g. balance a board while carrying it around without whacking anyone or anything), those jobs shift to robot directors that jump between multiple robots to handle the parts of a task the robots don't know how to do yet.

There's a number of good SF movies that use the remote work concept, and Sony/Kawasaki have formed a joint venture to attempt it in Japan. (https://www.theregister.com/2021/05/24/sony_kawasaki_robotics_jv/) The key idea here is to generate a big training database via the virtual work service.

The applicability to Mars colonization is also pretty obvious here – workers can stay in a safe, shirt-sleeves environment while working through robots out on the frigid, radiated, near vacuum surface.

Translation:

"its simplistic" = I can't give you a reason why it is wrong, but in my heart of hearts, I know it to be wrong

Well, the profit of Tesla will grow much faster than the actual sales volume because the fixed cost only scales minutely with increased volume.

In Q2 2021 Tesla had 1.48 EPS. Anualized, that would equate to a P/E ratio of about 120. When third quarter comes out, it may be at 2 EPS, which would reduce the (anualized) P/E-ratio to about 90. Wait another year with the same stock value and the P/E-ratio may be down to …45? 60?

To compare, Amazon is at 57 and Nvidia about 75. And this is assuming that FSD will give Tesla no boost in income over the coming year.

No, I don't think Tesla is a bubble that will burst.. In fact, as profits go up, I think that P/E-ratio will not drop below 90 because institutional investors will want to buy in more heaviliy…

Why are the EBITDA numbers for Tesla compared to the EBIT numbers for Ford and GM?

For those not familiar with the jargon: Earnings before interest, taxation, depreciation and amortisation.

Which are kind of bullsnot numbers anyway, because taxation, interest, depreciation and amortisation are huge, huge numbers for a car company. You can't pretend they don't exist except for very narrow, specialised comparisons.

More to the point, depreciation and amortisation are both large, so OF COURSE the Tesla numbers look better, you've ignored some major costs.

Which brings up another point: where is the plain, old fashioned, ordinary earnings numbers? When someone is using all the fancy EBITDA figures, but not giving the final earnings after we count everything, I get suspicious.

I’ve always believed that most of that cap was built up by those who see the potential of Tesla’s energy division, not their car company. Compared to car manufacturing worldwide, the energy sector is a much larger one.

The robot presentation was merely to entice prospective AI experts to work at Tesla. The robot won't come to fruition for 30+ years, if at all. Robotaxis, on the other hand, will be out in about 10-15 years, and they are a viable product.

Using Stellantis as an example, both of the charts you displayed are inconsistent with each other. Low debt (relative) yet a high probability of default, compared to other manufacturers who appear to be in a much more precarious situation.

That's a very simplistic way to look at it, this boundaries are imaginary. There is a lot of interest in their cars and that is the point. People that are in the market for a luxury electric car are not a die hard Tesla buyers, they buy Tesla because there are only little other options. Lucid plans to cascade down from luxury to affordable cars just like Tesla and more than enough financial backers.

A market cap of $700B and a cash flow of $4B. Tell me that isn't a bubble waiting to pop.

Not saying that when it pops Tesla goes bankrupt; Their debt to cash on hand and cash flow is quite good. But that market cap is absurd.

Seriously deficient analysis. Why do legacy automakers have so much debt? It's because they have captive finance subsidiaries. That finance sub debt is offset by auto loans and leases. Debt at the manufacturing sub level is much less. The idea that VW is on the verge of financial distress is laughable. $5 billion plus in earnings last quarter. And they are right on TSLA's heels in electric vehicles even without the fartapps and FSD vaporware.

I hope Lucid succeeds. But if Tesla is selling every Model S and Model S Plaid and Model X that Tesla makes, then Lucid will be taking future business from ICE supercars – Porsche, Bugatti, Ferrari. When EVs are over 50% of new cars then EV competition is taking from half or more from other EVs while killing off the rest of ICE.

Why is that?

I do think Lucid will take some of Tesla's business, but just from the high end.

Tesla is rightly trying to move down in price and up in volume.

The $25,000 Tesla model may start in China, but will probably enter many markets.

The Cybertruck is also competitively priced, especially the entry model.

Too many companies are going to try high end first, and that may saturate. The less compelling high end models may do very poorly, with just a few collectors buying them as an investment because they are scarce.

Ford is taking electric seriously. The Mach-E is doing fine, and the electric F-150 has a lot of people itching to buy it when it comes out: https://insideevs.com/news/524575/us-ford-plugin-sales-july2021/

The electric van should also do exceedingly well:

https://www.ford.com/commercial-trucks/e-transit/2022/

The only other electric van is the Rivian, but Amazon has a 100,000 unit order. That will monopolize their production capabilities for some time. Ford should be free to supply all the thousands of other businesses.

Of course we need to assume that Lucid production will be delayed forever.

Tesla could easily go BK. Their robot presentation was a $20 spandex suit,Boston Robotics makes robots, you won't see any Tesla robots for sale, just as there are no Tesla robot axis ,but there are self driving Waymo and GM vehicles.

First test drive. Article indicates they hope to start deliveries in 2021. Earlier in the year they were talking about 10,000 deliveries in 2021. $170,000 car. EVs take from ICE sales mainly. Someone buying a Ford F150 Lightning was going to buy or has bought a ICE RAM or ICE F150. Someone buying a Cybertruck was going to buy an Acura MDX or some other ICE vehicle.

The amount of money Tesla spends on robot development will be miniscule compared to its other products.

Meantime, serious competitors are piling up. Will Lucid over time become an equal competitor to Tesla?

https://www.teslarati.com/lucid-air-dream-edition-motortrend-review/

What happened the last time GM went bankrupt?

Because it will be the same response the next time they go bankrupt.

Well, tesla can easily go bankrupt for overconfidence investing too much in something absurd and useless as the tesla robots. It will not be the first company to have a solid product and fail chasing the wrong idea.