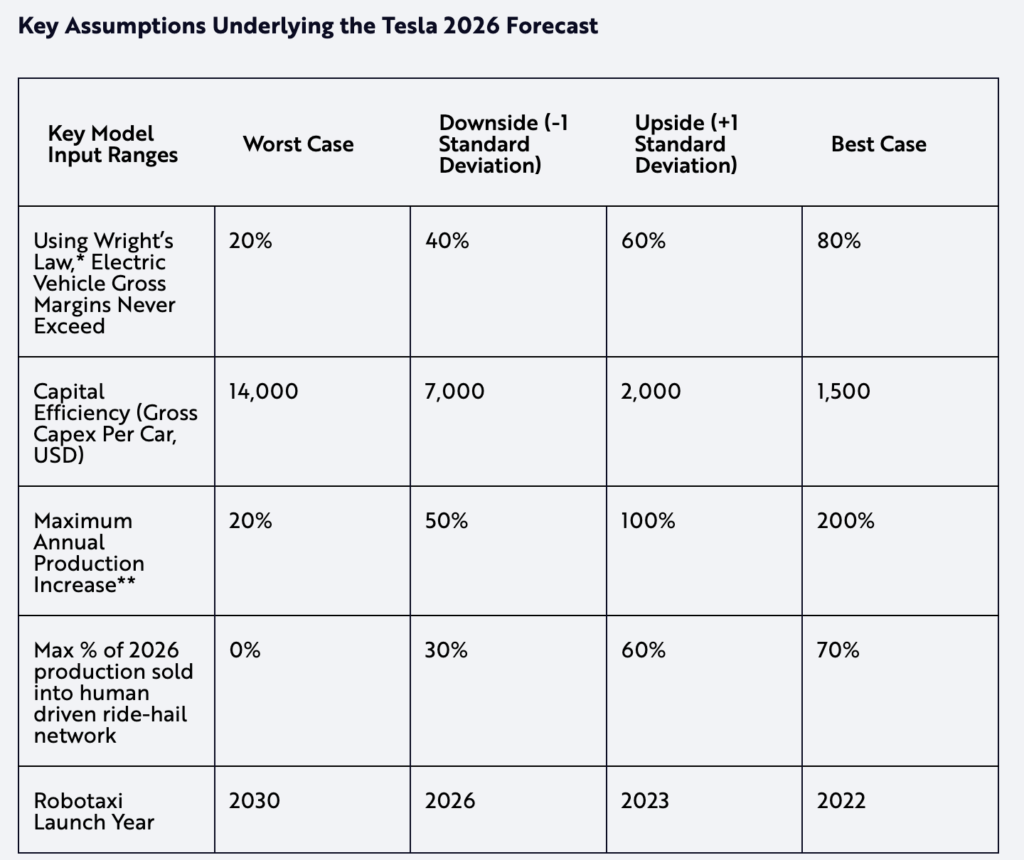

ARK Invest has updated its Tesla model and it provides new expected value per share of $4,600 in 2026. Ark Invest is famous for correctly predicting Tesla would run to over $4000 three years before they did. They correctly called a greater than 10X move.

This projection does not factor in scenarios where Tesla has a significant and profitable energy business or a significant Tesla bot business.

The average selling price per car is increasing. Model Y is becoming the top-selling Tesla model. Model Y is currently priced between $60000 and $70000. If there is continued greater demand for electric cars and Tesla’s in particular and inflation does not moderate then the average selling price could go to $70,000 and stay there.

The flood of iron LFP batteries coming from China and 4680 success could allow for 60-80 million cars per year in 2025 and 2026. If Tesla’s Master Plan 3 involves ramping with 8 new factories over the next 3 years then Tesla could ramp in a bull case to 40 million cars in 2026. This would require adjusting to how aggressively Tesla pushes in the next 6-18 months to expand factories. However, the Ark robotaxi scenarios are easily as aggressive as a big Tesla production push.

Doubling the bull case for production and double the ASP would 4X the stock price. A big and profitable energy business would increase it up to 5X or 6X.

I describe how there is a lot of batteries coming from investments already made in China. The factories are already under construction. Having a lot of batteries makes it easier to scale the energy business and car production.

CATL, a major battery manufacturer and one of Tesla’s main battery suppliers, is raising a whopping $9 billion to accelerate its production. CATL plans to reached a global production runrate of 230 GWh at the end of 2021. At an average pack size of 60 kWh,the 2021 runrate production battery capacity can make almost 4 million electric cars per year. CATL has shared plans to ramp production capacity up to 1,200 GWh by 2025, but it will need to grow a massive raw material supply chain in order to make that happen.

The battery cell manufacturer SVOLT, which emerged from the Chinese carmaker Great Wall, wants to significantly increase its production capacities planned for 2025 – from the previously announced 320 GWh to 600 GWh per year by this deadline. [Dec 2021] The company’s management also gave concrete figures: In addition to the annual production capacity target of 600 GWh from 2025 (for comparison: the current largest domestic competitor CATL plans 520 GWh from 2025), SVOLT published the figure of 400 GWh as the status of the order backlog in 2025 (orders from the passenger car sector only). It also said that it was in the process of building eight production sites with a total capacity of 297 GWh per year. Chengdu with capacity of 60 GWh in the third expansion phase. Plants in Huzhou, Nanjing and Suining and more.

CALB has raised annual power battery production target capacity to 500GWh for 2025 and 1TWh by 2030.

Gotion aims for 300 GWh per yearin 2025.

SOURCES- Ark Invest

Written by Brian Wang, Nextbigfuture.com, Brian has shares of Tesla

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Yes Paul, how many Bolts, BoltEUV, Lyrics and Hummer *do* you expect to be sold in June?

Lets start with the Bolt… In Jan, Feb and March it sold less than 130 per month [1]. The BoltEUV just launched [2], so at best – if the ramping is perfect- you could expect a couple of hundreds in June. Same story with the Lyric, going on sale in May [3] and could at best reach a couple of hundred in June [3]. And the hummer has been averaging 33 (!) per month in 2022 [4].

Let's do some addition assuming all goes well for GM.. Bolt+BoltEUV+Lyriq+Hummer = 130 + 200 + 200+33 =~560 vehicles in June. That should be compared to Teslas average of, say, 100k per month?

It's also interesting to look at how fast Chevrolet was scaling the production and sales of the Bolt before the fires. In January 2017 they sold 1162 Bolt's in the USA and in January 2021 they sold 2888. That equates to a growth rate of…about 20% per year. Tesla yearly scaling was +87% from 2020 to 2021.

Paul, it does not look like GM will have any meaningful impact on EV production any time soon…

(1) https://www.goodcarbadcar.net/chevrolet-bolt-sales-figures-usa-canada-monthly-yearly/

(2) https://www.cnbc.com/2022/04/06/gm-expects-record-year-of-chevy-bolt-ev-sales-following-fire-recall.html

(3) https://www.autoweek.com/news/future-cars/a39465500/cadillac-lyriq-ev-goes-on-sale-in-may/

(4) https://gmauthority.com/blog/gm/gmc/gmc-hummer-ev/gmc-hummer-ev-sales-numbers/

We know that Elon has stated that they will leverage their FSD perception in their robot. And we know that they have hired engineers and scientists – the job listings are public – specifically to develop the robot. So if you add those things together, the program "budget" is obviously far from zero.

This ignores other car makers, how many Bolts,BoltEUV,Lyriqs,and Hummers do you expect GM to sell just in June? Hummers have been resold for double, the public has a taste for GM EV's,then all the rest will sell well also.

GM is is light years ahead of Tesla in autonomy,there will be no Tesla network of drivers ubering for Elon.

Is China Tesla opening tomorrow or not? Isn't the port closed?

Tesla robot ventures consist of a $27 spandex suit.

FED money printing will send all prices much higher. Stock prices included.

BEVs do, HEVs just need the H.

1: Tesla has been (wisely) keeping product portfolio no larger than what can be supported by its cell supply. Tesla is growing production very quickly and only recently attained essentially unlimited financing to further fuel it. A fool would say Tesla should have slowed Model Y production so they could use cells to make less profitable new vehicle lines and increase their operating expense.

2: Everyone else is relying on terrible charging networks. Even if other automakers can start to produce competitive EVs, they are not showing the kind of foresight when it comes to supply chain that Tesla has. They are all thinking small, and trying to protect their dying ICE business.

3: Tesla actually has a strategy to utilize FSD technology when it is ready. They have millions and will soon have tens of millions of vehicles that could readily deploy the technology. If other automakers develop the technology they still need to build the vehicles. I too am more cautious about when the technology will be ready, but it will come, and when it does Tesla will be well-positioned to exploit it.

4: I (and ARK) place no value on the robot. We'll see what they can come up with. There is very little downside risk from it, though.

Hans, I don't have the patience to comment all your points. But at least you must concede Toyotas and Hondas robots are made with classical programming, i.e. a dead end. And that means that if Tesla goes full ANN perception and reinforcement learning, they could leap frog all of Toyotas and Hondas technology. Right? If they can execute, that is…

I find it silly how this author is letting his fandom for Elon and Tesla overshadow the facts.

The rumors of ICE cars demise have been greatly exaggerated.

The EV market needs to fix the long charging time problem, the lithium supply problem and the battery disposal problem, which is not somebody else's problem.

Part of the reason for this is a shortage of used vehicles too, due to a misread by car leasing companies and other suppliers who thought the pandemic restrictions would mean we'd all be driving less forever. Well, we are because of Stay At Home work, but more pleasure driving is being done. When there are more used EVs, new ones won't sell as well. Also, unless range anxiety and EV charging stations rapidly resolve and without charging ICE fill-up prices as some fast charging stations do, EV adoption will stall. Here in NYC, anyone who lives in an apt. is severely constrained by lack of practical access to charging stations, with almost no public garages to charge EVs overnight for apartment dwellers. It's simply infeasible to wait 30-45 minutes to fully charge an EV. Even 15 minutes is too long as it will cause lines when EVs scale. 15+15+15 in a line of 3 cars is completely unworkable.

Average new car price 1975 $3800. Avg new car price 1980 $7000 Average new car price 1985 $12000.

Average new car price 2019 $37000. Average new car price 2021 $47000.

The average price paid for a new non-luxury vehicle last month was $42,859, down $294 and marking the third consecutive monthly decrease.

In January 2022, the average luxury buyer paid $64,635 for a new vehicle, down $804 month over month but still more than $1,300 above sticker price. For comparison, luxury vehicles were selling for more than $2,400 underMSRP one year ago.

Inflation could stick and continue for a while.

Yes the world is transitioning to EV's. Yes this transition will be more rapid than most people realize. Yes Tesla is and will remain the dominant EV company. No. Tesla will not be selling 40 million Model Y at $70k four years from now. Even if Tesla could ramp production that fast, they couldn't sell them all for that price. $70K is an insane price to pay for a vehicle. Most people could never afford that. Right now Tesla is supply constrained so they can set the price high. Once they increase production there won't be enough wealthy people to sell them all to. At least not at $70K. That is why Ark is projecting ASP of $30-38K. Also people like variety. Not everyone wants to drive the same vehicle even if it is the best. Could Tesla sell 10 million Model Y per year. I think they could. 40 million per year? Absolutely not. Brain you have gone down the rabbit hole.