There is an income limit on the new US Inflation Reduction Act EV $7500 tax credit for new Electric cars in the USA.

There is a congressional report that details all of the items in the bill.

On page 14, the credit would be disallowed for certain higher-income taxpayers. Specifically, no credit would be allowed if the current year or preceding year’s modified AGI (adjusted gross income) exceeds $300,000 for married taxpayers ($225,000 in the case of head of household filers; $150,000 in the case of other filers).

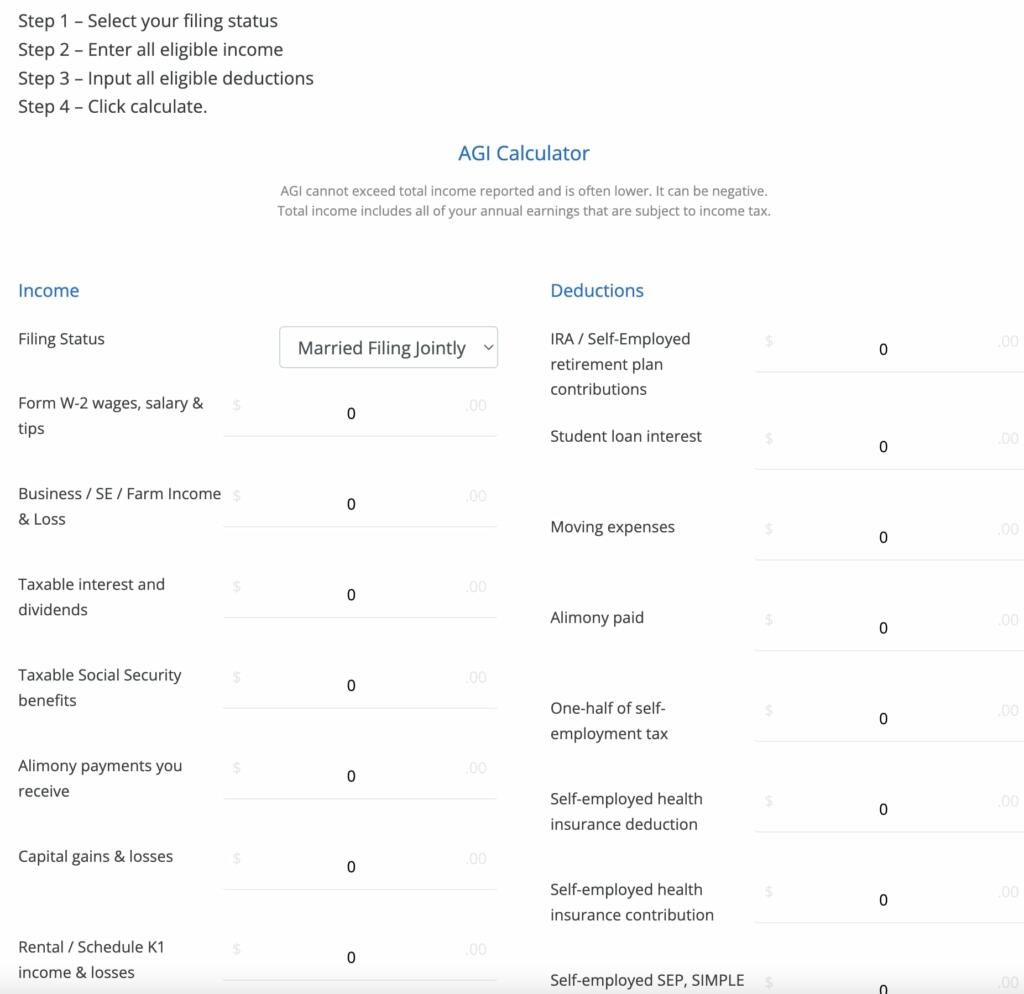

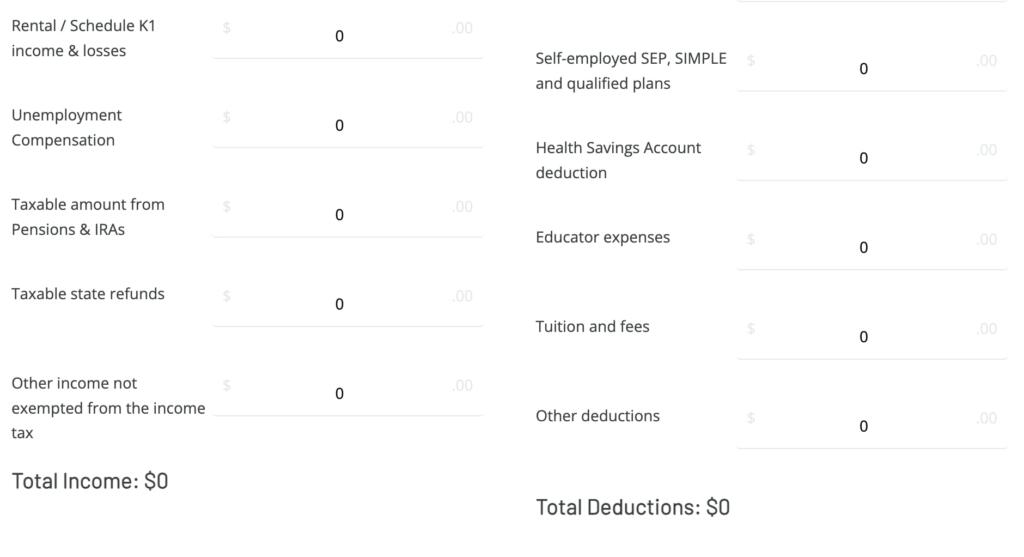

There is online calculator for adjusted gross income.

How to calculate Adjusted Gross Income (AGI)?

Using the income tax calculator, simply add all forms of income together, and subtract any tax deductions from that amount. Depending on your tax situation, your AGI can even be zero or negative.

If your total income from all sources is over $300k then it could be brought back under with retirement savings plans, tuition, alimony payments and investment losses.

Only certain cars qualify for the tax credit. Tesla and GM cars will not qualify until Jan 1, 2023. This is based upon when they timed the removal of the credit being for the first 200,000 cars. There are also rules around the cost of cars and how much of the cars and batteries are made outside the USA.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Does it matter? If you make over the limit you can arrange to have it bought by a family member or friend that is under that limit and then resell or lease/gift it to you.

Second question would be if the EV you want qualifies for the credit. As far as I can tell none of the Audis or Kias do, only ID4s made in USA do. As time goes on even US manufactured vehicles may have problems because of lithium and cobalt mining requirements.

This new credit situation is a mess. Winners seem to be Tesla, GM (ugh), and Ford.

Per IRS. Here is what qualifies (sales cap means you have to wait until after Jan 1, 2023)

—2022 Audi Q5

—2022 BMW 3-series Plug-In

—2022 BMW X5

—2022 Chevrolet Bolt EUV — Manufacturer sales cap met

—2022 Chevrolet Bolt EV — Manufacturer sales cap met

—2022 Chrysler Pacifica PHEV

—2022 Ford Escape PHEV

—2022 Ford F Series

—2022 Ford Mustang MACH E

—2022 Ford Transit Van

—2022 GMC Hummer Pickup — Manufacturer sales cap met

—2022 GMC Hummer SUV — Manufacturer sales cap met

—2022 Jeep Grand Cherokee PHEV

—2022 Jeep Wrangler PHEV

—2022 Lincoln Aviator PHEV

—2022 Lincoln Corsair Plug-in

—2022 Lucid Air

—2022 Nissan Leaf

—2022 Rivian EDV

—2022 Rivian R1S

—2022 Rivian R1T

—2022 Tesla Model 3 — Manufacturer sales cap met

—2022 Tesla Model S — Manufacturer sales cap met

—2022 Tesla Model X — Manufacturer sales cap met

—2022 Tesla Model Y — Manufacturer sales cap met

—2022 Volvo S60

—2023 BMW 3-series Plug-In

—2023 Bolt EV — Manufacturer sales cap met

—2023 Cadillac Lyriq — Manufacturer sales cap met

—2023 Mercedes EQS SUV

—2023 Nissan Leaf

Your link to the calculator is messed up.

sorry fixed. It was not closing the congressional report link