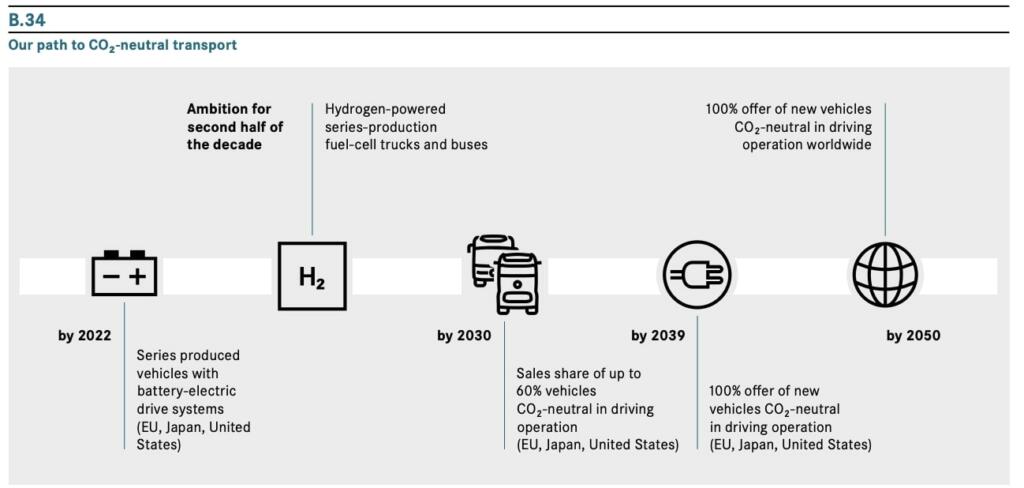

Tesla has committed over $10 billion for Semi truck factories, megapack factories for megacharging and for the research and development of Semi trucks. Tesla is targeting the production of 50,000 Semi trucks in 2024. Daimler Trucks owns Freightliner and makes over 500,000 large trucks every year. Daimler has about $1 billion in research and development and the product of the portion of that research for electric trucks resulted in the eCascadia with (150 and 220 miles of range) and in the 300-mile range eActros which will start series production in 2024. Daimler is splitting its effort between reducing emissions from regular diesel trucks, developing hydrogen trucks and buses and improving electric trucks before ramping volume production.

In 2021, Autoweek discussed the reluctance to adopt electric Semi trucks by fleet operators.

* trucks have new engines so they still have to prove they can hold up to standard over-the-road rough conditions.

* the charging infrastructure set up to handle the expected volume.

* The trucks must make sense from a cost standpoint. These are commercial vehicles. Fleet usage depends on costs, not environmental issues. The government will need to provide subsidies for the use of electric trucks for a period of time, until advanced technology lowers the cost of operation.

Daimler Truck introduces electric Freightliner eCascadia into series production in North America. After well over one million test miles (over 1.6 million kilometers) in daily customer operation, Daimler Truck and its U.S. brand Freightliner have presented the production version of the all-electric eCascadia. The start of production was in 2022. There are a few hundred eCascadia trucks that have been built and delivered.

The Mercedes Benz Truck eActros LongHaul is scheduled to be ready for series production in 2024 with a range of around 500 kilometers per battery charge.

Expenditure on research and development in the Trucks North America segment amounted to €599 million and thus rose significantly compared with the prior year (2021: €467 million), which was significantly influenced by the exchange rate. Thereby the focus was on the continued development of zero-emission vehicles, increasing fuel efficiency and performance of existing products.

The electric trucks at Daimler Trucks are not included as separate line items in their financiall statements 293 page annual report. The bus division with over 20,000 buses per year has separate line items.

Tesla has committed billions of dollars to use all of the 40 GWh/year Nevada battery factory for Semi truck production in 2024. The charging infrastructure for Tesla Semi will be using Lathrop Megapacks. Lathrop can make 10,000 Megapacks each year.

Big OEMs and some startups have been developing electric trucks. They expect the regulations to tighten to the point where low-emission trucks are basically mandated.

Rodriguez-Long, who works in asset management for US 395 Motors and spent 30 years in heavy-duty truck dealer management, sees many problems that have to be addressed before electric trucks take over the roads. “The cost of this technology is very high at the moment,” he said. “Just like the EV cars, the makers will have to adjust their pricing and apply profits from other products to get closer to something that makes financial sense for the buyers.”

Sticker price alone is not all there is to overcome.

“The biggest obstacle is the infrastructure or lack thereof. To charge 3,000 to 10,000 pounds of batteries in a short time is challenging. No one is talking about the cost, but electricity will need to be generated somehow to be able to service these new chargers. I have attended two significant conferences this year on this topic. None of my questions was answered”.

In 2022, the California Public Utilities Commission approved a $1 billion vehicle electrification charging project, with most of the money earmarked to accelerate the number of midsize- and heavy-duty trucks on the state’s roads. The program will start in 2025 and run through 2029, with $200 million allocated each year through the state’s utilities. The charging infrastructure for trucks will be installed at a variety of places, including truck stops, ports and at facilities owned by companies that manage fleets. Transit agency depots are also potential sites for buses.

Gov. Gavin Newsom’s executive order banning the sale of new gasoline-powered passenger cars by 2035, the mandate also directed the California Air Resources Board to develop regulations requiring all operations of medium- and heavy-duty vehicles to achieve zero emissions by 2045. The rule goes into effect by 2035 for drayage trucks — vehicles commonly used to transport freight from an ocean port to a short distance, or what transportation analysts call the “first mile.”

The state budget includes $10 billion over the next six years to put more electric cars and trucks on roadways and in ports. The federal government’s Infrastructure Investment and Jobs Act will funnel several hundred million more dollars to California for similar efforts.

$1.5 billion in subsidies is enough for most of the costs of 5000 electric Semi trucks per year at nearly $300,000 per truck. The Freightliners of the world would be trying to scale their truck production to these subsidy levels. None of them believed a major shift to electric Semi trucks was imminent. They were targeting 2030 or later.

In 2022, Truck makers are divided into two camps. One faction, which includes Traton, Volkswagen’s truck unit, is betting on batteries because they are widely regarded as the most efficient option. The other camp, which includes Daimler Truck and Volvo, the two largest truck manufacturers, argues that fuel cells that convert hydrogen into electricity — emitting only water vapor — make more sense because they would allow long-haul trucks to be refueled quickly.

It takes years to design and produce new trucks, so companies will be locked into the decisions they make now for a decade or more.

“It’s obviously one of the most important technology decisions we have to make,” said Andreas Gorbach, a member of the management board of Daimler Truck, which owns Freightliner in the United States and is the largest truck maker in the world.

Battery-powered trucks sell for about three times as much as equivalent diesel models, although owners may recoup much of the cost in fuel savings. Hydrogen fuel cell vehicles will probably be even more expensive, perhaps one-third more than battery-powered models, according to auto experts. But the savings in fuel and maintenance could make them cheaper to own than diesel trucks as early as 2027, according to Daimler Truck.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

No, they are not as committed as Tesla and therefore should be kickrf out of the way and leave te field to Tesla only, every narcist knows that.

KGB – I’m pro EV, but anti banning ICE vehicles. Let the market decide the winners & losers, subsidy free.

I think as EV’s become better (cheaper, longer range, faster charging, etc) then people will want to switch over, banning the competition just shows that you can’t compete, and EV’s CAN compete, and in many cases, win.

Germany is the most atmospheric carbon dioxide religious nation. Citizens of Bonn, Germany recently voted a referendum on phasing out internal combustion engines. The vote was 20% to phase out and 80% to retain internal combustion engines.

Electric vehicles have a small market without government edicts. Like most irrational religions global warmists are rabid about forcing their unfounded beliefs on the majority. Time will tell.