Being the World currency is similar to like have the Iron Throne in Game of Thrones. The holder of the Iron Throne in Game of Thrones has won critical battles and has powerful Bannermen and allies/friends. The final loss of the crown comes at the end of a long and obvious erosion of trust and power.

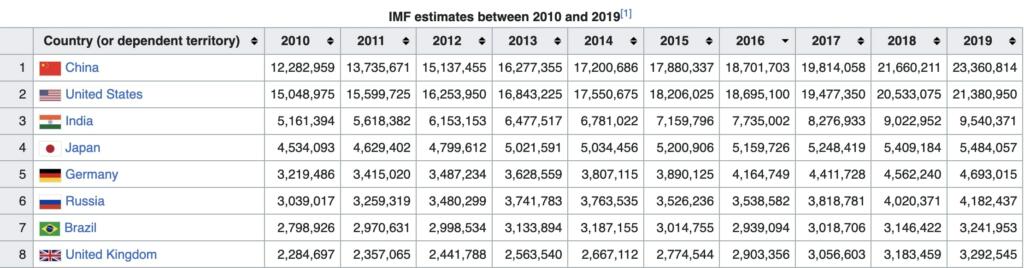

The United States surpassed the United Kingdom in GDP in 1890. However, the British Empire The US also surpassed the UK in population in about 1860. According to Angus Maddison’s PPP GDP database, the USA passed the GDP PPP of the British Empire in 1916, during the First World War. The US GDP pulled a little ahead of the British Empire in subsequent years, but the gap didn’t widen significantly until the late 1930s. Then during the Second World War US GDP doubled and Britain’s didn’t.

1900: BE $395 billion, US $312 billion

1916: BE $554 billion, US $559 billion

1938: BE $678 billion, US $799 billion

1944: BE $804 billion, US $1714 billion

India was almost half of the British empire in GDP. India and Pakistan gained independence in 1946.

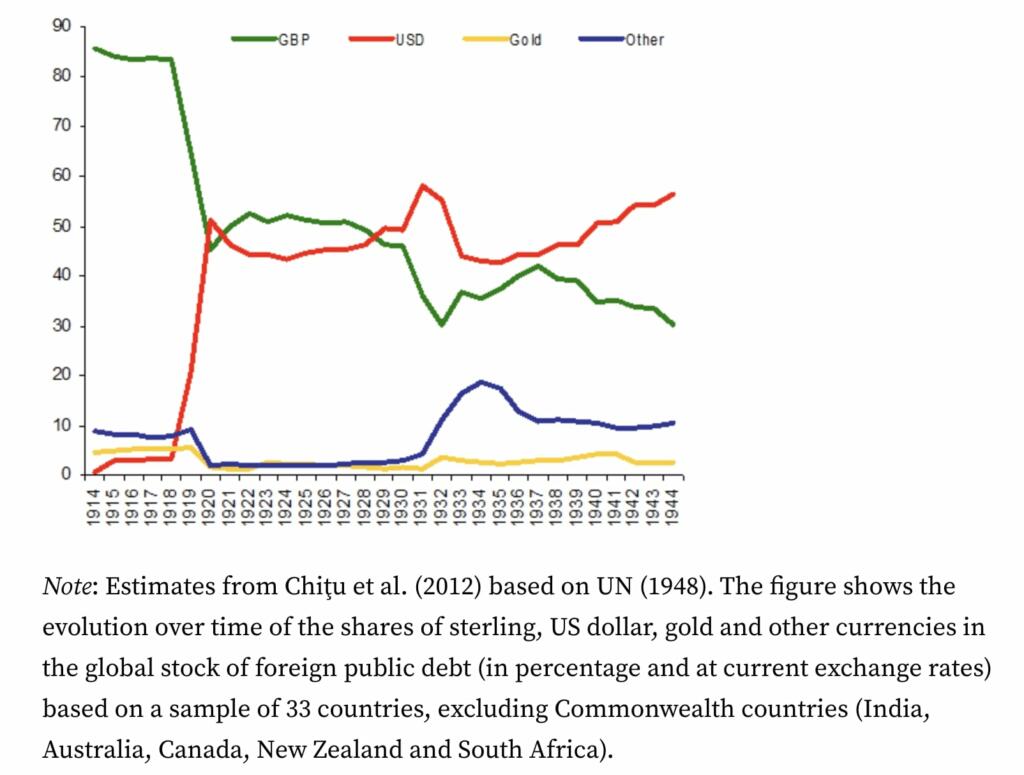

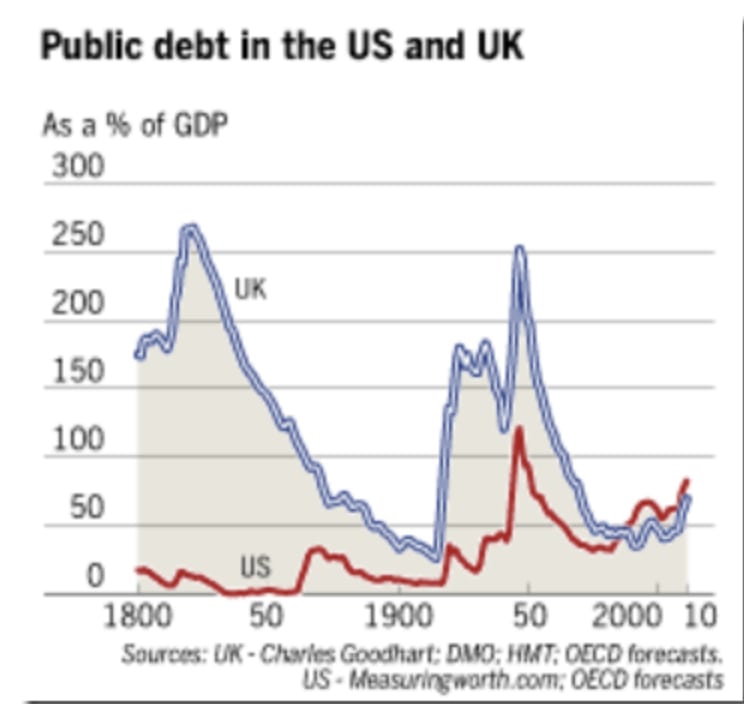

It was 56 years after the US passed the UK that the US became the reserve currency. This is despite becoming co-reserve currency from 1919. It took two world wars to dethrone the UK. The UK had more debt but that was fine for decades until they had to take a 10% of GDP loan in 1946 to make payments.

China passed the USA in PPP GDP in 2016. China now has 122% of the US PPP GDP. However, China’s allies or power circle is weak.

India was the critical part of the British Empire. It is again a critical part of the American Dollar Empire and World economy. India has a PPP GDP of $15 trillion.

China is trying to lead a group of countries (BRICS 21) to reduce the usage of the US dollar. Currently, the US dollar is used for about 58% of currency reserves and 20% for the euro. The China yuan is behind the yen, pound. In 2022, the U.S. dollar accounted for 58% of global foreign reserves. This is a higher share than the euro (21%), Japanese yen (6%), British pound (5%), and Chinese renminbi (3%). China does not seem to be making the other countries join them and the renminbi. China can try to lead the world into some kind of digital multi-currency financial world. There would no longer be an Iron Throne Reserve Currency. There would be multi-polar world with many currencies, which would be made manageable with computerized transactions and conversion.

The United States made a loan to the United Kingdom after World War II to help the UK’s economy. The loan was called the Anglo-American Loan Agreement and was signed on July 15, 1946. The loan was negotiated by British economist John Maynard Keynes and American diplomat William L. Clayton. The loan was for $3.75 billion and was repayable over 50 years. The UK’s national debt in 1946 was £27 billion. The debt-to-GDP ratio peaked at 252% in 1946. The UK had a GDP in 1946 of £10.7 billion. Canada contributed $1.19 billion to the total loan. The US gave a loan what was about 10% of UK GDP.

Why did the UK have to use the US dollar from 1946 for a large share of their wealth? They had to make US dollar debt payments.

Before that they had to buy a lot of US oil. This was done for decades. But there was a power balance as to whether critical trade contracts were done in US dollars or in pounds.

The US could lose the exchange rate largest economy crown in the next decade or two. Currently, it seems that China will not pass based upon superior economic growth. The US economy would need to stumble. The US dollar value would need to collapse by about 40%. Whatever causes this to happen has to be completely or mostly avoided by China’s economy.

The friendly nations and allies of the USA would need to abandon the US dollar and much of US trading.

If this happens the US and the dollar could be brought low, but like the pound the US dollar would stay relatively strong for decades. It does not seem like China would inherit a reserve currency crown just because it is a large economy. China would need to be utterly dominating at around 50% of the World economy. Otherwise, China needs allies and friends to get to a large percentage. China is not attracting strong allies and alliances with China are not helping the economic power of the other country. The US provides military power and support to other NATO members. China’s Belt and Road has not improved the capabilities of those who join the effort. If China cannot inherit a reserve currency crown, they could work to weaken and dethrone the US dollar as reserve currency. A multi-currency world where China has own of the top five currencies and there is no truly dominant currency.

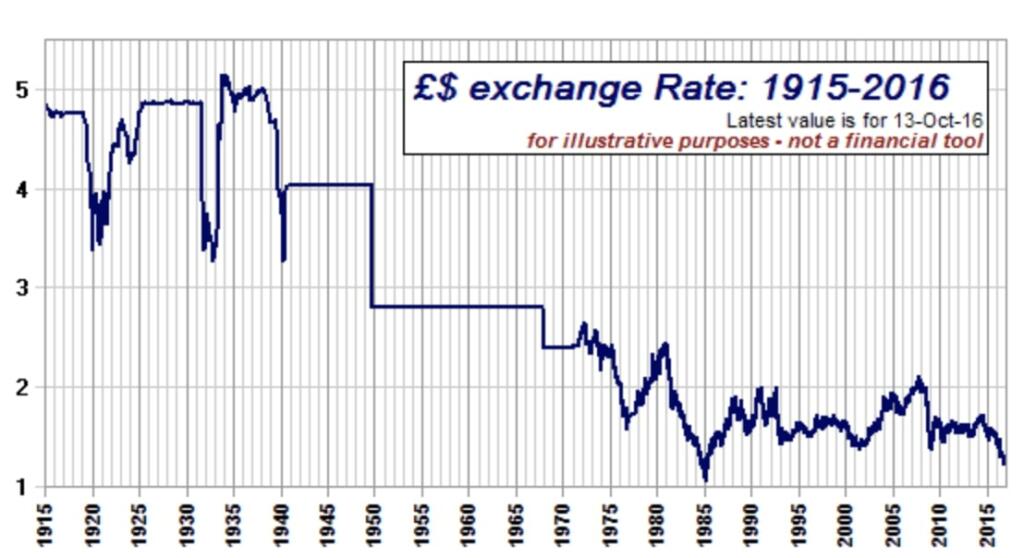

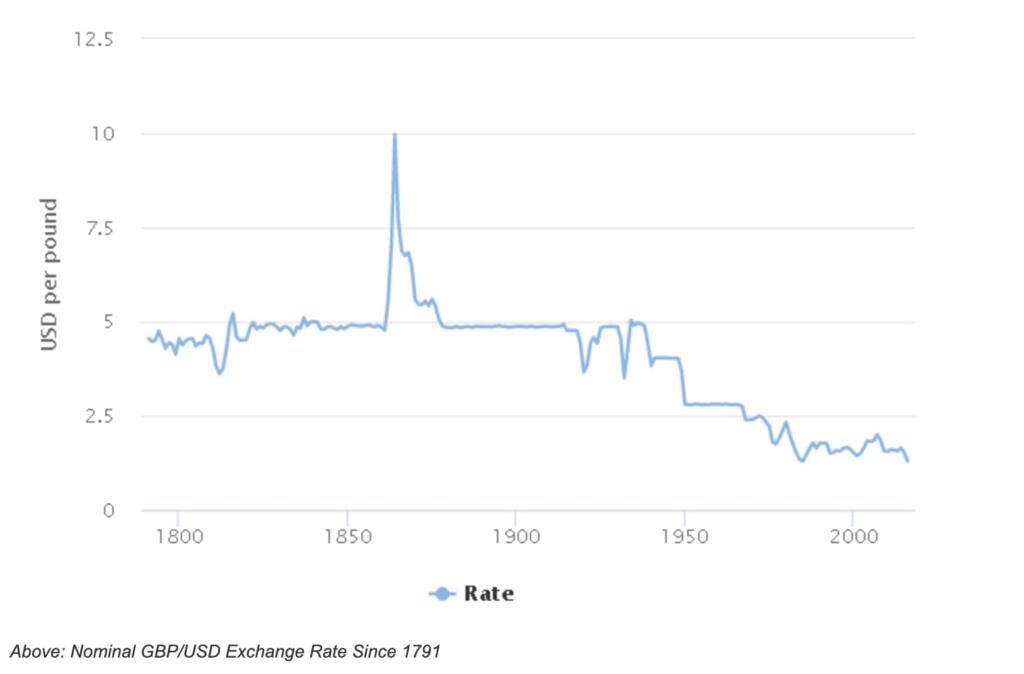

Losing Reserve Currency Status and Exchange Rates

The early 1800s for example saw the Pound Sterling depreciate against the Greenback to $3.62 during the Pound-weakening Napoleonic wars (1803 -1815). For the US Dollar, the US Civil war (1861 – 1875) saw the Dollar depreciate vastly, sending the spiking to $10 to the £1.

Entering the 20th century just shy of $5, the next big development for the cross saw the Sterling come under pressure during World War One (1914 – 1918). The abandonment of the gold standard and the financial burden of the Great War saw the GBP/USD decline to $3.66.

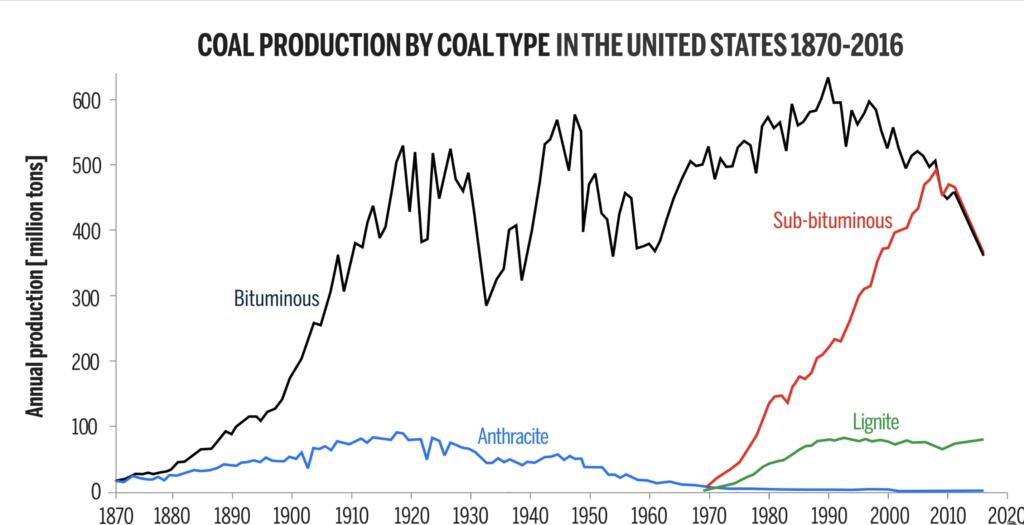

Energy and Making Hard Assets

The UK was a dominant energy power with coal. However, the US overtook the UK in energy production with oil and coal.

The Federal Reserve Act of 1913 created the Federal Reserve Bank to respond to the unreliability and instability of a currency system that was previously based on banknotes issued by individual banks. This was the same time that the U.S. economy became the world’s largest, surpassing that of the United Kingdom. World commerce still centered around the U.K., though, as the majority of transactions took place in British pounds.

The British Empire’s GDP peaked in 1938 at $683.3 billion (£542.8 billion). In the 19th century, Britain was the world’s richest and most advanced economy. The British Empire’s economy grew through sugar, tea, silk, and tobacco. All profits were sent to Britain.

Between 1945 and 1965, the number of people under British rule outside the UK itself fell from 700 million to 5 million, 3 million of whom were in Hong Kong.

India’s trading partners today:

United States: $71.5 billion (18.1% of India’s total exports)

United Arab Emirates: $25.4 billion (6.4%)

China: $23 billion (5.8%)

Bangladesh: $14.1 billion (3.6%)

Hong Kong: $11.3 billion (2.9%)

Singapore: $10.65 billion (2.7%)

United Kingdom: $10.37 billion (2.6%)

India’s exports are led by refined petroleum, diamonds, packaged medicaments, jewelry, and rice.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

China cannot become the world reserve currency unless it floats the yuan and runs massive trade deficits. China, at least under the CCP, will do neither of those things.

The US dollar is the world reserve currency for a reason. Peter Zeihan lays it down here: https://www.youtube.com/watch?v=LiR54FPQiCs

No need to worry about a competition or a threat from China any longer. China is crumbling silently inside very badly. The only fear is the intermediate global instability that its fall will bring.

https://www.youtube.com/watch?v=mqA5NODRnQI&list=TLPQMjAwOTIwMjNdY_493kVt_A&index=7

USA will continue to use the Dollar as their reserve currency.

EU will continue to use the Euro as their reserve currency.

Japan will continue to use the Yen as their reserve currency.

UK will continue to use the Pound as their reserve currency.

So if China wants to grow their reserve currency status then they are going to have to do it not in the USA, EU, Japan, or UK. Or Canada, Australia, Korea, India, Philippines, etc. Best of luck to China in getting the world to adopt a currency that isn’t freely exchanged as the reserve currency.

You don’t become the new reserve currency by being a worse managed currency. You become the new reserve currency by being a much better managed currency. I’d pick BTC as the next reserve currency over the Renminbi.

I laugh when the BRICS tout a gold back BRICS currency. Chinese and Indians would cash out for gold until there was not gold left. A gold backed currency that cannot be redeemed for gold is not a gold backed currency.

Muammar Kadafi tempted fate when he decided to float a gold backed currency and accept only that currency for oil. Uncle Sugar was not pleased. Last I heard he was sodomized with a bayonet.

Debasing the currency is the only feasible way to default on the national debt and bring wages and social benefits down to the world value of unskilled labor. Woke colleges are pumping out unskilled labor that the market cannot absorb. The rightful place to work a degree in social studies etc is a textile mill or Amazon delivery. The world living wage is $2/person/day.

The American standard of living was on par with the world until USA lucked into a monopoly of manufacturing after WWII. Americans lived in tar paper shacks, grew their food in gardens, raised chickens and pigs, hunted and fished, could not afford medical and dental care, walked to the grocery store, cooked their own food, and shared a bathtub once per week.

Universities need a to require Humanities majors get a minor in Latte art so that their graduates have a useful skill.

Americans lived in tar paper shacks, grew food in their gardens, raised chickens and pigs, hunted and fish, could not afford medical and dental care, walked to the grocery store, cooked their own food, and shared a bathtub once per week?

As you stated, this was on par with the world. Who cares?

The U.S. lucked into a manufacturing monopoly after WWII? It wasn’t luck, my friend.

Look at British teeth today, for gosh sakes.

Look at Chinese teeth today, for gosh sakes.

This is the reason the U.S. came out on top.