There was the battle control OpenAI. It was a fight about control of OpenAI, its board, and its direction. Now Elon wants to get more voting control of Tesla. He wants to go from 15% to 25% in order to be comfortable making Tesla the leader in AI and Robotics.

I believe this is more evidence that we are close to getting Singularity levels of AI and humanoid bots.

Sam Altman told Bill Gates. “We [OpenAI] have to go do this thing [make super AI with super robotics]. This is now an unstoppable technological course. The value is too great.”

Elon Musk has reasons for concern about voting control. Elon did not have enough control of OpenAI. Elon co-founded OpenAI but could not control its direction.

I am uncomfortable growing Tesla to be a leader in AI & robotics without having ~25% voting control. Enough to be influential, but not so much that I can’t be overturned.

Unless that is the case, I would prefer to build products outside of Tesla. You don’t seem to understand…

— Elon Musk (@elonmusk) January 15, 2024

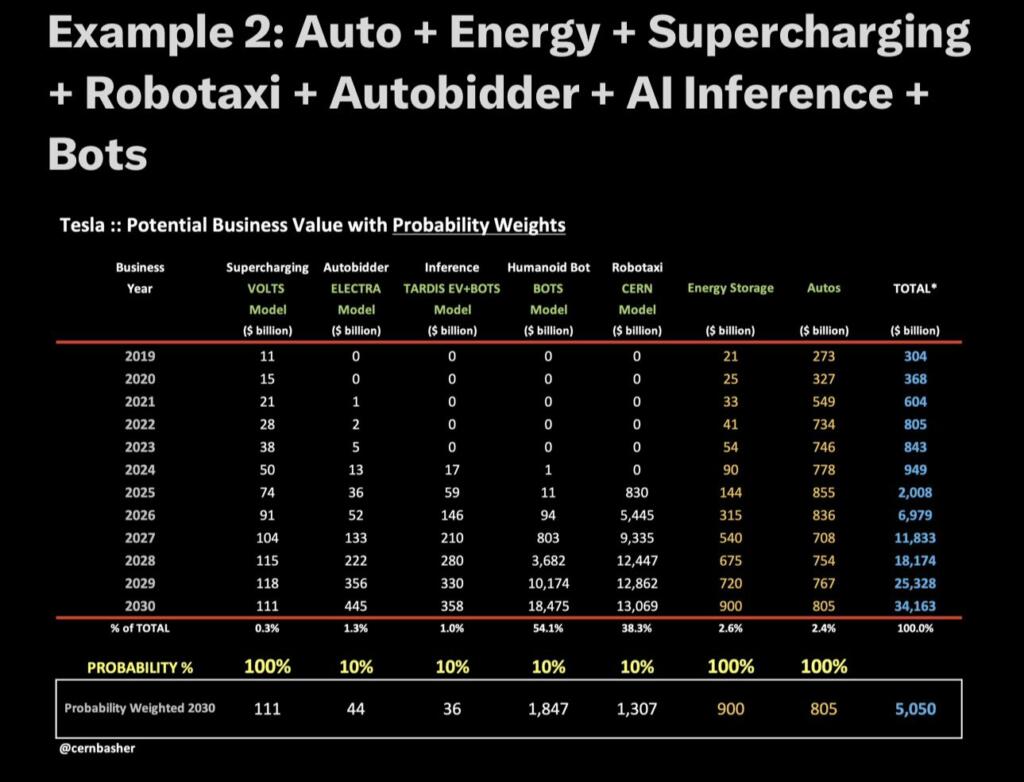

IF there is a 10% chance Teslabot can come a $10-100 trillion thing by 2030 then it is hugely important how it happens.

IF the Tesla opportunities that Cern Basher sizes are correct for 2030, then the important task for Elon Musk is to increase the probability of Teslabot success from 10% to 100%.

If there is a new Tesla CEO compensation package that awards 1% more voting shares for each major objective, then it will be like the 12 labors of Hercules.

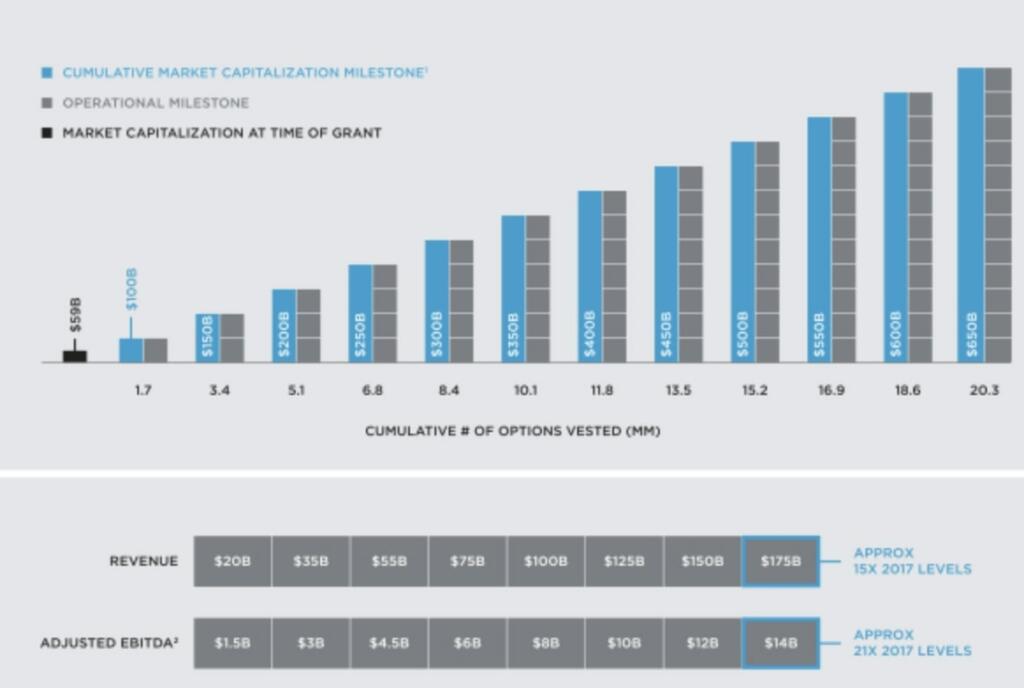

Five years after the 2012 Performance Award was put in place, Tesla’s market capitalization has increased 17x. The Board believes that the 2012 Performance Award played a significant role in Tesla’s operational and financial success by properly aligning Mr. Musk’s incentives with the best interests of Tesla and its stockholders.

Four years after the 2018 CEO compensation plan, Elon again increased Tesla’s market capitalization by about 16x.

If there was a new 2024 CEO compensation plan and Tesla again increased 15x in market capitalization within 4-5 years then by 2029-2030 Tesla would be worth about $10 trillion.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Most CEOs would be eligible for food stamps and Medicaid on this sort of comp plan. What has any stakeholder got to lose by repeating the comp plan? Stockholders are only hit with dilution from his options if the company is ridiculously successful. It costs the company per se literally nothing. Creating options doesn’t take away a dollar of profit from reinvestment. Opposition to this amazingly successful and fair pattern seems perverse.

because so many of these people dont understand the actual pay plan. they just hear elon musk is the wealthiest person alive etc but dont understand his actual liquidity. his alignment with core company objectives is honestly veryr are and its why the company is so succesfful