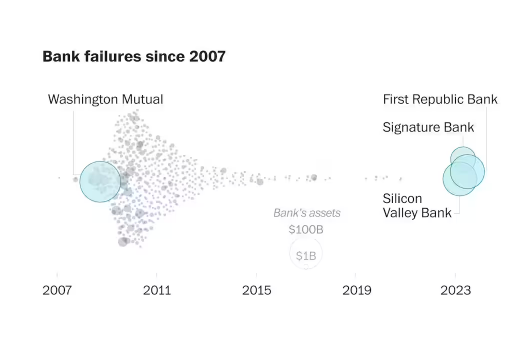

3 of America’s 4 largest bank failures have occurred in the past two months. This has cost FDIC’s deposit insurance fund ~$35 billion. The fund started the year with about $125 billion.

$20 billion for Silicon Valley (mainly bailing out uninsured depositors)

$2.5 billion for Signature

$13 billion for First Republic

By many measures, this it the worst year in bank failures.

Academic Researchers have found that 190 more banks with $300 billion are at risk of failure.

The ones that seem most at risk are PacWest Bancorp, Western Alliance and Zion.

3 of America's 4 largest bank failures have occurred in the past two months.

In total, it has cost the FDIC's deposit insurance fund ~$35 billion.

$20 billion for Silicon Valley (mainly bailing out uninsured depositors)

$2.5 billion for Signature

$13 billion for First Republic pic.twitter.com/I2leti80Kg— Heather Long (@byHeatherLong) May 1, 2023

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Those crazy companies that put all their funds in one bank and knew it wasn’t SDLC should not be getting 100% of their losses made up.

It might (might) be argued that having them lose it all would be worse for the country than reimbursing it, but I would argue even if that were so, reimbursal should have been considerably less than 100%. They won’t learn otherwise, and everyone else will get the wrong message.

It was obvious to me that there was something wrong with the loan market at least 2 years before the fist bank collapse. And in the last 2 years of Bushes presidency he didn’t do anything significant to address the situation. Obama had to clean the mess up and work with congress to pass rules to prevent recreance. he spent his entire first term fixing it. And fighting the republican congress every time the debt limit was reached. During his second term obama got the rearly deficit down to close to zero and the banks were heathy.

Then truep came into office. spending went up every year he was in office and the republicans increased the debt limit 3 times without doing anything to reduce it. And to cap it off they indeed some of the banking regulation Obama put in place. Now Biden and deocrats have to pick up the pieces and put everything back together again with the republican blocking judge presidential appointments, and the one debt limit increase that Biden has faced.

Apple is offering between 4 & 5% interest on demand accounts. Skinflint banks will lose all their deposits. They thought they had no competition and they thought wrong. They thought investing in mortgages and US Treasury bonds were safe and they thought wrong. They thought banker’s hours would trap money in the banks and they thought wrong because wire transfers work 24/7. They thought commercial real estate was a good investment. We’ll see.

Best economy ever.

Thanks Brandon

Its a lot better than the crap we’ve got in the UK right now. Brandon could be doing a lot worse. (Assuming your comment was sarcasm. It might well be an honest appraisal…)

Problem being here in the US Brandon’s administration is still saying that the economy is strong and the greatest ever and inflation is down (because inflation is lower compared to a year ago, not because inflation is actually down).