Microsoft was already spending over $10.7 billion per quarter to build out data centers and AI compute (Q4 2023). There are reports that Microsoft will increase this capital spending to $50 billion per year. This would be averaging $12.5 billion per quarter.

This capex spending is up from $7.8 billion in Q3 2023 (Jan-Apr 2023). Amy Hood, CFO at Microsoft, told analysts on a conference call the money is to support cloud demand, including investment in AI infrastructure. This includes new datacenters plus more “CPUs and GPUs and networking equipment. Microsoft has invested about $13 billion in OpenAI. Microsoft was at $3 billion per quarter on mostly AI instructure and will now go to about $5 billion per quarter.

Microsoft, along with AWS and the other major hyperscalers already account for 37 percent of the world’s datacenter capacity. Amazon, Google and Microsoft each has 150-200 hyperscale data centers in operation, and each has another 80-100 in the pipeline.

Google, cap-ex investment was $13 billion in the first half of calendar 2023 versus $16.6 billion a year earlier. Ruth Porat, ex-CFO and newly crowned President and Chief Investment Officer, said part of this is related to delays in certain datacenter construction projects. Google will need to double its 2023 spending to match Microsoft plans for 2024.

Yikes! pic.twitter.com/sJI97R9DJK

— Elon Musk (@elonmusk) November 20, 2023

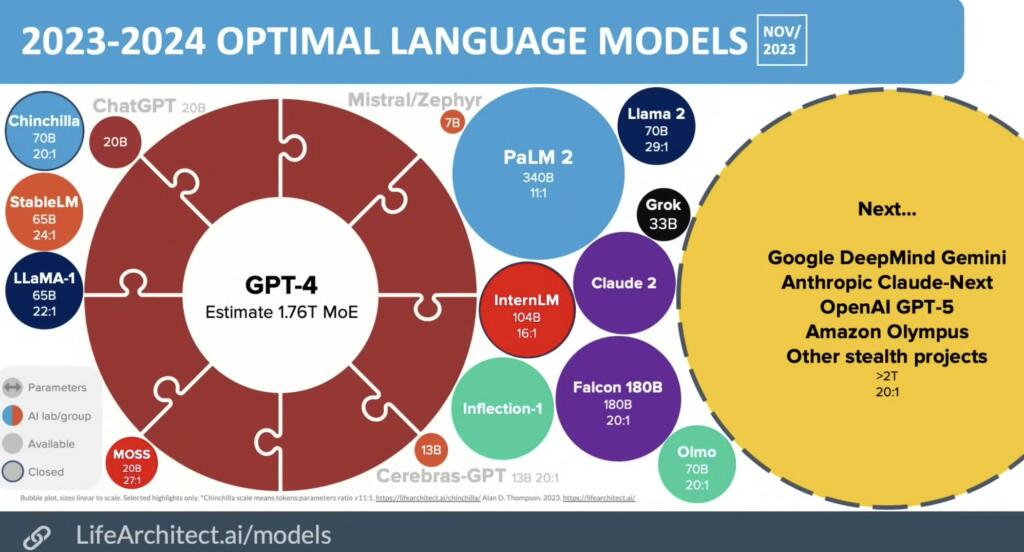

There are several analysis of an OpenAI breakthrough in AI.

According to Gartner, the worldwide infrastructure services market grew by 29.7 percent to hit a total of $120.3 billion during 2022, up from $92.8 billion the previous year. There was $48 billion in 2022 revenue for AWS and nearly $26 billion for Microsoft Azure. China’s Alibaba cloud came in a distant third at $9.28 billion, just beating Google Cloud into fourth place, which had revenue of just over $9 billion. Huawei snuck into the top five global IaaS providers with $5.25 billion in revenue and 4.4 percent market share.

Cloud and AI-driven spending will climb 20% to 25% in 2024 and will outpace expectations for a modest increase in IT budgets. Microsoft seems to be increasing AI driven spending by 60-100%.

If OpenAI has a real breakthrough to AGI or ASI that requires massive compute to accelerate, then all of the other major players will have to develop the improved scalable models and increase budgets. This would mean further increases in sales and share price for Nvidia and AMD. There will need to be a build out in energy production as doubling or tripling the amount of AI compute will require even more electricity.

In 2023, data centers consumed about 200 terawatts hour (TWh) per year globally. 90 TWh are directly attributable to the three largest hyperscalers: Amazon, Microsoft, and Google.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

The link says $50B per year on cloud.

Some fraction of that will be spent on AGI.

I’ll start worrying when AI can create an account on NBF on its own, and leave original intelligent comments spontaneously.

Brian, do you mean Terrawatts per hour? Which would describe a peak consumption situation, this is a significant issue for planning for grid operators and utility generators particularly when considering things like charging truck fleets and operating server centers.

Or did you mean “Terrawatt hours” per year which would described the total number of Megawatt, Kilowatts, etc expressed as a Terrawatts consumed for an hour per year.

One is an immediate demand description the other is a total of energy consumed during the period (year) described. I’m pretty certain your mean total energy consumed, and not the peak energy demanded.

However, I am becoming more and more concerned about server peak use times equating to peak power demand. This is more and more of a concern involving AI’s and other machine intelligence. So it could be a peak draw concern. Maybe AI farms will have to throttle based on how much energy is available during peak consumption periods, and how much that power costs.