In the first quarter, Tesla produced over 433,000 vehicles and delivered approximately 387,000 vehicles. They deployed 4,053 MWh of energy storage products in Q1, the highest quarterly deployment yet.

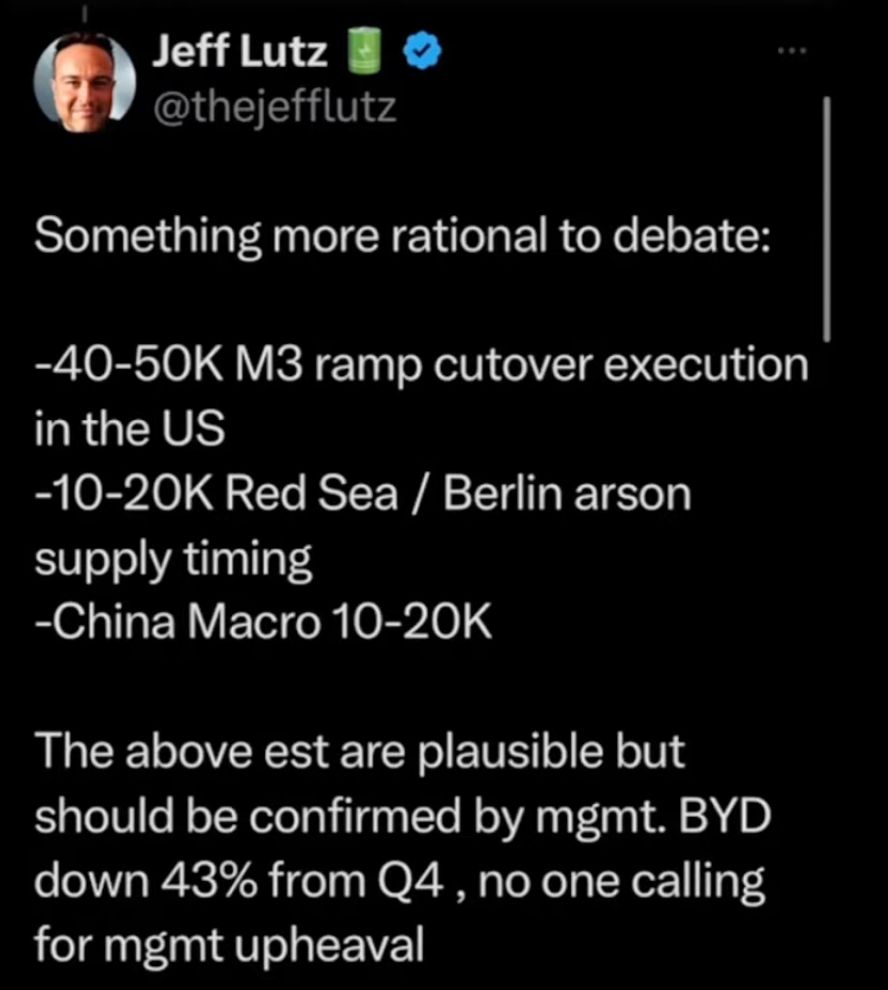

The delivery numbers were bad for Tesla in Q1. There were fires in Berlin from ecoterrorists and delays in the supply chain because of Persian Gulf Houthis. China had weak numbers. There was also the delay in transitioning to the refreshed Model 3 Highland in the US Fremont factory.

Tesla has the one month free trial for FSD 12.3.3 out to 1.8 million Tesla owners. If 5% chose to buy or subscribe then this would 90,000 new sales. Any full sale would be $12000 vs just over $8000 in profit on a car. A full year subscription would be $2400. It would take three subscriptions for one year to be about the profitability of a car.

90,000 FSD with 30,000 as a full sale and 60,000 as a subscription would be equal to the profit of 45,000 cars immediately and 20,000 additional car profits while the subscriptions last.

If 15% additional chose to buy and subscribe in North America and in China over the rest of 2024 and the mix was again one full sale and two subscription this would be for about 4 million possible cars. 600,000 FSD with 200,000 full sales and 400,000 subscriptions. This would be the profit from 300,000 cars immediately and 130,000 additional car profits each year while the subscriptions last.

21,000 FSD sales is a one percent increase in margin. The 5% sale scenario is about 4% more margin and the 15% scenario for US and China would be about 20% more margin.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

An EV winter is beginning, industry wide retrenchment, bankruptcies and scaling back of plans by legacy auto and likely political moves to end subsidies. Given large Tesla margins (~$8k/car) they can still prime the pumps through price reductions, but a lot of purchasers will still take a $22k Corolla over a $39k model 3, particularly given growing consumer understanding of downsides of EVs.

Tesla FSD 12.3.3 with less than 500km between critical disengagements https://www.teslafsdtracker.com/ has to figure out how to prevent 999 out of 1000 critical disengagements to get to the ~500,000km between accidents that humans achieve. That doesn’t seem possible to me given FSD12 has been on the road for 8 months already, the rate of improvement isn’t even remotely near high enough to give any confidence that it can ever get that reliable (on current hardware at least). Their HW4 computer is only ~200 Tflops, while latest Nvidia GPU is ~20 Pflops and would only cost a few $1000k in mass production (once AI demand spike abates). So there is up to 100x processing boost possible if that is what it takes to make FSD work.

Tesla’s robots are the big play in my view. They are likely to be bigger earner than EV cars in a few years

While its not a great quarter at all, part of what makes a good, stable, long term company is how they weather headwinds (be they macro or micro). thats just the way the system and the world works. The biggest issue to me for Tesla isnt competition but the very clear trend of EV sales stagnating or even shrinking.

Ford cut the mach-e price, and are now selling 3 times as many. It all boils down to the price, the world is a mess, with many wars, and a weak economy.

I think Tesla is positioned well, hopefully through factory efficiencies, they are able to cut a few thousand off the prices by the end of the year. Which will help with sales.

I think they will be having Teslabot in their factory later this year, if it proves to do real useful work, that will be a game changer.

Elon Musk harvested the gullible. EV is a no sale on merit.

Now the delusionals are looking for a wonder weapon to save their master. Soon they will be hit again with the same truth Autonomy will not be achieved if the machine does not have awareness. They are still steps away from the bigger realization that there is no money in making cars, electrical or not.

Very bad for short-term / day-trading investors.

For long-horizon investors, it means a buying opportunity.

Model 2 cannot come fast enough. FSD unsupervised cannot come fast enough. Energy storage cannot come fast enough.

There are multiple PsyOps operations targeting Elon Musk, and by extension, Tesla. Automotive Unions. Ford and GM. The Biden administration and Democrats. Mark Zuckerberg, Jeff Bezos and Bill Gates. Big Oil and the associated Republican representatives who support Big Petro. European Carmakers. It’s amazing how strong Elon has remained, despite the onslaught of negative attacks against him.

I see the world as it is, not as I wish it to be. It will be 2 years before Tesla experiences the growth in sales we’ve come to expect. Margin growth will climb slowly, but then quickly after the full ramp-up of Model 2, MegaPacks, FSD, and Teslabot/Optimus.

Hang on.

It’s going to be a wild ride…

Agreed! Though nothing Tesla can do or say will ever be “fast enough” for those that want Tesla to fail. We are living with a system that allows financial sabotage to companies when others of big money want to slow, halt or eliminate another company. Black Rock execs have bragged they they can decide winners and losers with who they back and they aren’t totally wrong. That is before we have the controlled Mainstream Media which does not have what is good for people anywhere narrative. But Tesla is a very strong company working on many very innovative products with a very impressive set of executives and employees. If anyone can keep on a path though slowed with the toxic crap of all that want it to fail for their own gain or satisfaction, it is Elon and his team. Just ignore those that want you to eat bugs, those that want you to own nothing and like it or those that are provoking WWIII and agree to just hang on and stay on path.