Long time readers of Nextbigfuture know that I have been optimistic about China’s economy for well over two decades. Those were correct and accurate tracking and forecasts. There would be complaints that tracking the situation every few months was boosterism for China.

Well the change has happened.

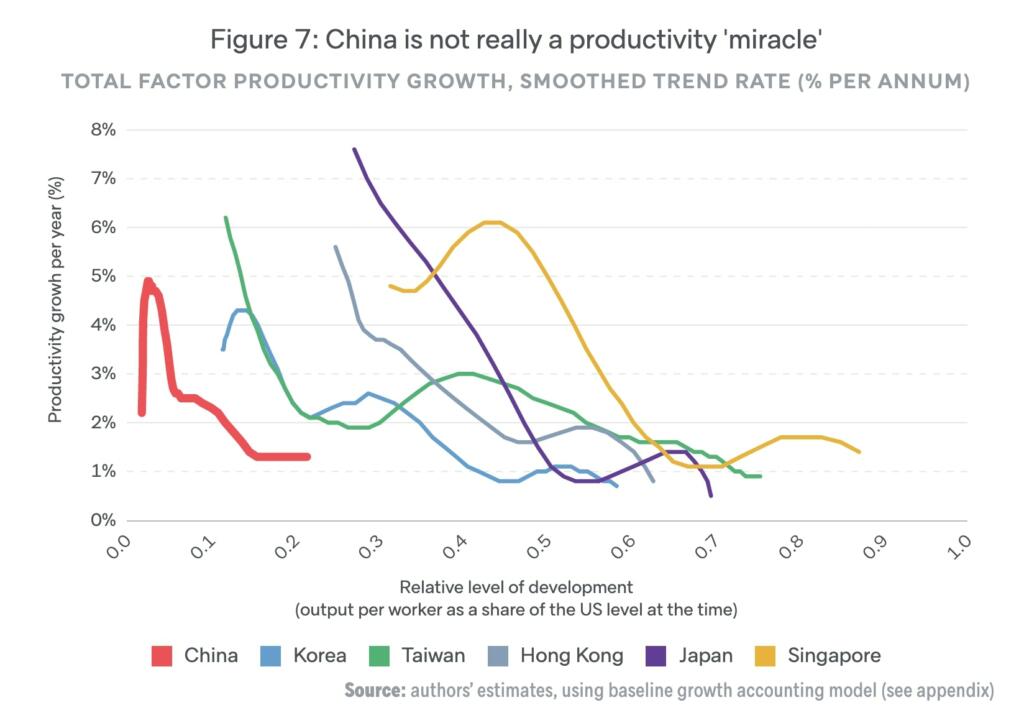

China’s economy has basically stalled out. China’s economy was extraordinary and outperformed relative to other countries. It did this by catching up. Catching up is a big deal especially for the largest national population in the world.

There are those saying China will have an economic collapse because of the real estate and debt crisis. I believe that China will mostly be able to avoid those situations. China has levers that they can pull that other countries cannot. China can tear down millions of homes if there was a glut of overbuilding. China’s leaders can appoint some companies to complete buildings that a major company could not complete. They can force home buyers to continue to make payments or face jail penalties.

However, letting situations deteriorate where such extreme measures are needed shows a lack of competence.

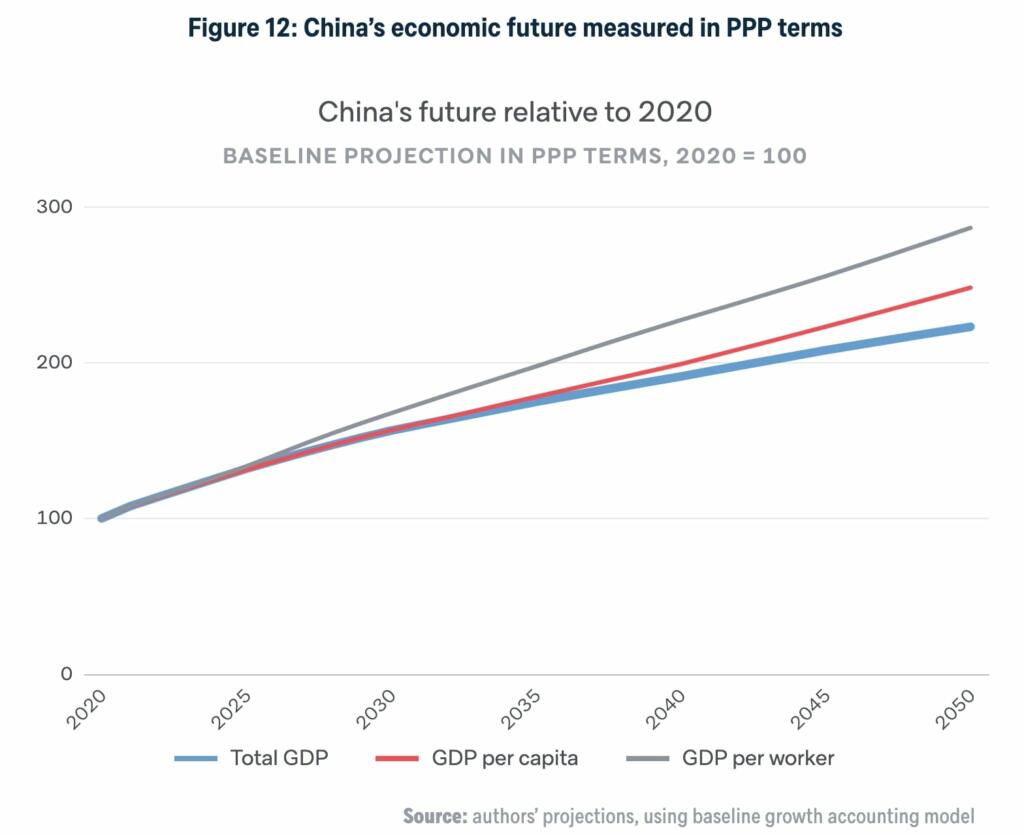

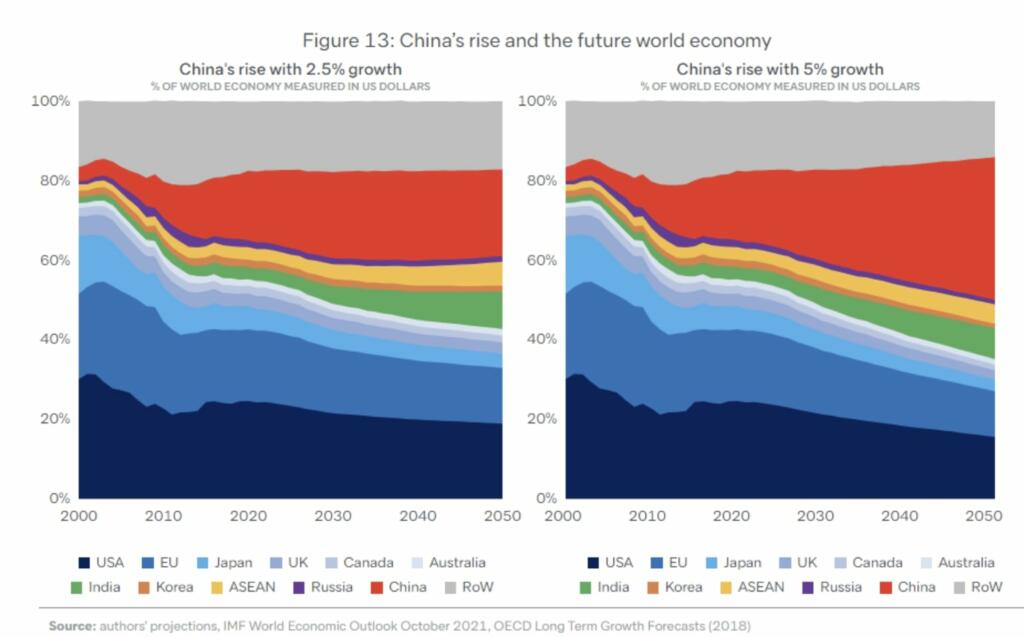

The Lowy Institute used to also forecast China’s economy rising out to 2050. They now have adjusted that downwards and I agree on the downward revision. The central expectation should be for Chinese economic growth to be around 2–3% a year to 2050, implying a significant downward revision in the narrative of a rising China.

I also have a forecast that the world could see massive economic improvements from self-driving cars, humanoid robot in the 2020s and 2030s and radical life extension in the 2040s. However, those technological improvements will not be layered on top of a continued economic boom in China.

China’s overall economy is larger than the US on a purchasing power parity basis. It is about 1.2 times bigger than the US. China now might get to 1.3 to 1.4 times bigger than the US economy and then peak at that level.

Over the past two decades, China’s housing investment is estimated to have doubled to 14% of GDP, accounting for about half of all private fixed investment. By comparison, total real estate investment was 6% of GDP in the United States at the height of its own construction boom in the mid-2000s. Real estate investment could drop by 10% of GDP to 4% of GDP.

China can still experience economic booms and busts but it will not be from an average trajectory of +7% per year of +5% per year. China’s economy will be at a middle of the global pack level baseline.

If China started doing everything right they could get to 5% per year economic growth and perhaps get to double the US economy in 2050. However, China has not been going everything right for a decade or more.

China faces a -10% drop in its workforce for every decade from now to 2050.

China economy could even drop to -1% or -2% per year from the global baseline. This will be because of the workforce decline and the real estate and debt issues.

China would be like Japan and Europe if radical life extension were developed. If suddenly people over 65 were as healthy and active as people in their 30s or 40s then countries with a lot of old people would greatly benefit and see five to ten years of up to 10% GDP growth. However, this is unlikely to happen at scale until the late 2030s at the earliest.

There are currently no economic miracle countries in the world. There some countries doing relatively OK. India can get to about 6% GDP growth and Indonesia and many ASEAN countries are near that level.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

“I was right about China’s long-term outlook. It took a different course to what I expected but I was still right up until then.”

Watch Peter Zeihan’s videos on China.

His predictions are much more dire.

So…NextBigChina is finally R.I.P.?

China has achieved in 50 years—increasing life expectancy from the 40s to over 70—what it took many European countries a century to accomplish. That sounds great and it is, but the old-age dependency ratio in China is expected to soar to 53 percent in 2060, implying that, by then, one working-age person will have to support one elderly person. This is as opposed to 7.6 workers for every elderly person in 2016.

Traditionally, in Chinese society, the young are expected to revere and take care of the old. But this means that every young person coming of age is likely to have two parents and four grandparents. If they marry that just means four parents and eight grandparents.

Then consider that any young woman is apt to be in the same boat. She is unlikely to find the time or resources to have many, if any, children. And this is even with twenty-five to thirty million extra men are available (due to female infanticide during the several decades of the one child policy).

It gets worse. Consider the marching legions of the Chinese military, proudly displayed in the news and on social media. Then recognize nearly every one of those young men was an only child. And if that young man marching in uniform should fall in battle or even a training exercise? Four grandparents and two parents are without any support for their old age.

The pressures to take on all of this responsibility have created a backlash in the young called the ‘tang ping” culture. This means “laying flat” and basically equates with the newer term, “quiet quitting” that is being used in the western world, where people are deciding to just do the minimum and no more. Chinese censors have been hard at work trying to suppress all mention of this trend.

Ah, but what about pensions and entitlements and such? Sadly, the Chinese never really funded much of this. Moreover, given the unavailability of most forms of investment, the populace has invested an estimated 70% of its savings in real estate, and the vast majority of this is about to be lost, as the demand for empty shells of apartments, unsuitable for ever actually living in, even if they were in places where people wanted to live, has dissipated and the Ponzi-like environment that spawned them is crashing.

And this is almost as bad as the simple fact that investment continued for so long after it became apparent that a demographic disaster had already occurred and demand for housing could only go down.

And this isn’t nearly all of it the problems besetting the Chinese economy. Like the fact most regional and local governments are primarily funded from the sale of real estate. Or COVID lockdowns, or climate change, or pollution, or corruption, or the exorbitant costs of surveillance society, or tearing down their own overly successful businesses, or the failure of the greater prosperity belt and road initiative, the driving away of foreign investment, et cetera.

Even three trillion in Forex funds represents very little of a buffer on these scales.

“China has achieved in 50 years—increasing life expectancy from the 40s to over 70—what it took many European countries a century to accomplish.”

They’ve done that BECAUSE of European countries, not independent of them.

Thanks for raising this point – same as Africa too.

I find Peter Zeihan’s assertion that China is basically screwed because of catastrophic demographics persuasive. Its ultra-Orwellian turbo centralized ethno fascism won’t help.

What your view point of India? How can India do better?

India has younger demographics. India is growing at about 6% per year but with still growing workforce, India should be growing at 8-10% per year if it was replicating the China miracle period. India needs to build up more infrastructure (energy generation etc…).

But surely a lot of the “Chinese miracle” was fueled by their rampant industrial espionage, of the sort India can’t expect to get away with. And deliberate help falsely premised on the notion that as they got wealthier they’d evolve into a freer society. (And probably actually due in part to their having compromised a lot of policy makers.)

I don’t see how India can realistically duplicate those factors.

Japan had 20 years before it completely lose its economic growth momentum (1970-1990). During that time, its nominal gdp jumped from 220 billion$ to 3.5 triliion$. China will have about 30 years before it completely lose its momentum because its sheer size give it advantage of economies of scale.

The problem is that China’s current demographic state is similar to Japan’s in the year 2000.

Even though China can maintain growth by increasing the level of informal workers to formal, and rural to urban. This trajectory will end in ten years. I am unable to see continued economic growth unless China dramatically changes its economic structure, and political system to accomodate and harness these economic changes.

True. But you need to take in account that the fertility rate of US, UK, EU (main competitors of China and Japan) today is also much lower than period 1970-1990.

“China can force”, “China can order”, “China can appoint” — this all sounds like Command Economy nonsense. This is precisely the reason why China has fallen into this situation. Command Economy forces are not the same as the distributed forces of a Free Market Economy. But Absolute Power Corrupts Absolutely, so Command Economy it is.

Yea. It’s like because they pull their levers, the problems will go away instead of be exacerbated.

Any “surplus” housing in China should be turned over to citizens that paid for a promised dwelling, that was never built.

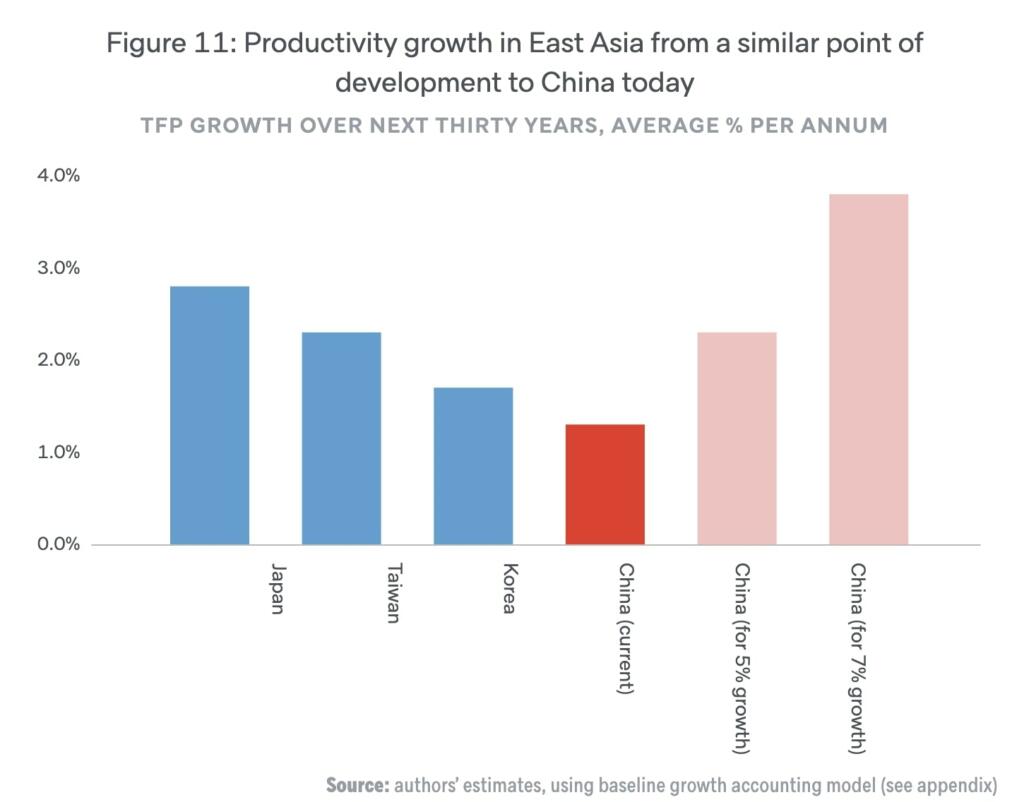

Figure 7 is really insightful, havn’t seen that before.

You’re assuming China remains a coherent political hierarchy and doesn’t enter a civil war, like how it’s usually been in its history.

It also assumes – and a BIG assumption it is – that the U.S. and Taiwan don’t get into a near term war with China, as we are getting closer to doing almost daily now. If that happens, all of Brian’s forecasts will seem extremely rosy, and not just for China either. Potentially, what’s left of humanity could be thrown into a 1,000 year Dark Ages then.

Some intelligent people think WWIII has already begun, ostensibly with the West and Japan against Russia. But China and Russia are closer than ever thanks to both this Administration and the previous one’s ham-handed and incoherent policies with respect to China, so it is really becoming a new Axis of Russia-China vs. the U.S. and Europe with Japan a nervous ally hoping it can avoid getting too involved if the shooting starts (it probably can’t). Africa, Australia, and the Far East would also like to avoid involvement, but that will only be possible if the war is quickly over…but then there might be radioactive fallout to worry about, so…

There’s a second problem with China that few are discussing intelligently. I talked about it with economist Michael Hudson when my activist group was sponsoring him at Pace University’s Left Forum for a couple of years.

As Brian points out, China has become overly reliant on its Real Estate sector over the past decades. It’s really a Land Bubble, not just housing. It’s Land speculation.

A Land Value Tax – Hudson, who advised China closely for decades, and I agree – is needed to permanently quash Land speculation and to focus government revenues where they belong: on the increasing value of land, instead of wages, true capital gains – like buildings – sales etc. If China were to shift its taxes to Land instead of these productivity-sapping things, it could also continue to grow at 4-6%/year, given its correct application of monetary policy. A sovereign country like China does not have to worry about debt it owes itself. It can create money indefinitely, but it is resource-constrained, like every other country, or person, on the planet. The LVT would untax buildings while taxing the location underneath them. It’s tried and proven with 100s of studies since its most famous proponent, Henry George (I’ve read all 8 of his books and taught at the Henry George School for a while, as well as led a Georgist activist group and written articles and a book about it, as well as monetary policy and public banking, which I’m still active in as well).

So you’re a proponent of Georgism or Geoism. Makes sense, since land is an inelastic resource, unlike buildings and other infrastructure built up on it. We should tax the inelastic things rather than the elastic things, in order to reduce the phenomenon of rent-seeking.

Nobody wants another 3 decade Cold War, but it’s far preferable to a hot war. Instead of criticizing this U.S. administration or that administration, let’s look to the future.

Political systems run for the lifelong benefit of an egomaniac are violations of U.S. governing philosophy, and we should never embrace this type of leader.

Our adversaries in Asia will soon collapse of their own decrepitude. Best to be strong, respectful ( to other U.S. citizens) and patient.

Part of the problem, though, is that China’s government DOES have levers it can pull, that other countries can’t. They’re too much of a command economy, and the more they pull the levers, the more of a command economy they become.

Which is great as long as the commands are the right ones, but has that ever been the way to bet, in the long run, when it comes to command economies?

They are mired in the party ideology and as such, they have and will eventually go wrong again due to it.

Look at the one child fiasco. According to the Malthusian party line, it was necessary.

Now it’s their biggest source of worries and upcoming problems.

They would have suffered a population crunch regardless, like everyone else, but that policy made it happen even faster.

When all you have is levers to pull you pull them all.