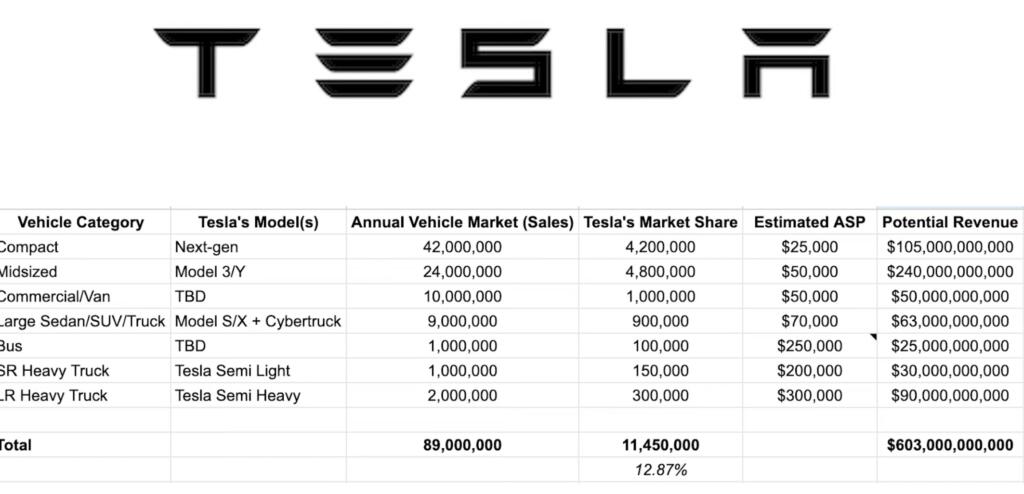

There are many electric car and truck analysts who project Tesla only capturing 20% of the electric Semi truck market and pickup truck market, SUV, Bus and Van markets. Tesla provided their estimate of the scale of those markets in their detailed Master Plan part 3.

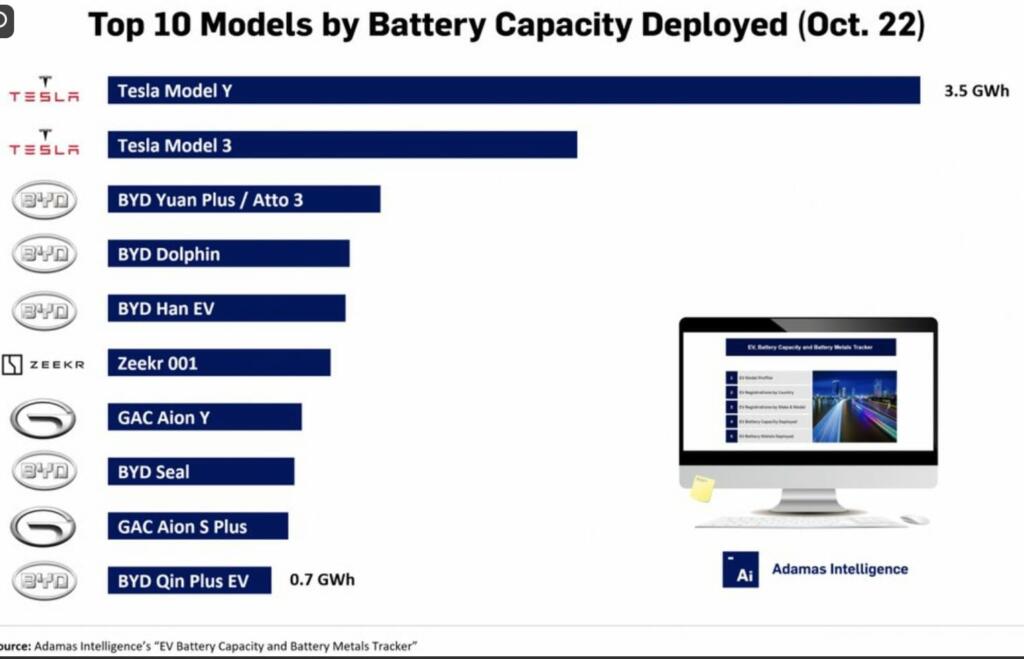

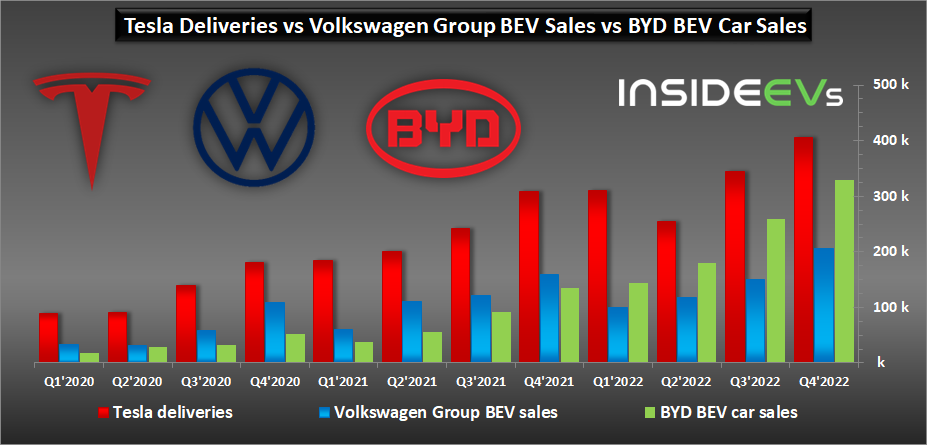

Electric trucks and vans will take making a large amount of batteries. 19 million vehicles (10M vans and 9M trucks) each year using 100 kWh batteries is 1.9 TWh per year. 10% market share electric vans and truck market share would take 190 GWh/year. Tesla is leading the world with the use of most batteries. Tesla still uses over double the batteries that BYD does and over six times as much as VW or other car makers.

Any other electric truck and van company that was wanting to capture 10% of the global saturated mature large electric vehicle markets would need to scale ot 190 GWh/year of those class of vehicles. They would need to scale to 1.9 million large electric vehicles per year.

Tesla is leading the scaling of batteries and the technology for efficient and powerful heavy electric trucks could lead to the level of domination that Tesla has in the USA electric car market. This is 60-70% market share. Tesla should be the one who has 1 TWh/year to make 5 million Cybertrucks per year and 5 million Cybervans per year.

Tesla is projecting 3 million heavy (Semi and large) trucks per year. They will need 2.1 TWh/year of batteries. If Tesla dominates these electric heavy trucks with 80+% market share, then they would need about 1.6 TWh/Year of batteries for 2.4 Million heavy trucks.

Tesla will have huge challenges scaling to multi-terawatt hours per year of batteries and electric vehicles. Tesla has the factories and battery supply to scale to 50,000 and a funded expansion to 250,000 large electric Semi trucks per year. This would be at the existing Nevada factory which is undergoing a $3.6 billion expansion for more batteries and Semi production.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Bryan,

I love your analysis. But it isn’t earnings I care most about. It’s net profit.

What do you anticipate will be Tesla’s net profit when they hit the magic 20,000,000 vehicle/year mark plus selling significant amounts of MegaPacks? (I speculate ~$300-400 billion annually). I think most people consider net profits to be the true measure…

Vertical integration as a strategy to rule the EV world?

Careful.

The world is littered with the failed S.Korean, Japanese, and US monster, mega-companies that felt that owning and dominating all aspects of the supply-chain will lead to unquestioned capitulation and control – a system to print endless cash and keep standards and community infrastructure under a single over-Lord.

This may have limited success under home appliances, limited personal consumables and electronics, even some transportation industries –

but automobiles and business road vehicles?

Anti-Trust legislation under a 2023 – 24 Fed political system with Europe’s increasing influence? It doesn’t even have to be large-scale dismemberment – pause, disrupt -as SpaceX knows so well, will be the required time for the mines, upgraders and factories, dealers and distributers to catch up — “thanks for starting the industry Elon, we’ll take it from here” – Ford, VW, Audi, Toyota, GM… CEOs. Why compete honestly when you can delay, obstruct, and sabotage your way to marketshare. Interesting to see Q1 2027 US EV numbers.

Well, it depends on your model.

Is Tesla Apple or Microsoft?

I used to think Apple would crumble from competition. No shortage of well-funded competitors. Cell-phone market (with its underlying app system) is the only comparable market to land-based vehicles.

Tesla is aiming for 15% of market, with an underlying lock-in app – the FSD self-driving system.

Tesla is also aiming for market domination in grid-leveling batteries. Again, lots of competition. But no one has made headway like Tesla. It seems within a few years Megapacks could be 30% of Tesla revenues.

I am not mentioning humanoid robotics until Tesla actually makes one that is useful for manufacturing and home chores. Still…they have the Dojo ai supercomputer. If that hits, and Musk can assemble a world-class team around it (like he’s done at Tesla cars and SpaceX rockets), then who knows?

The fact that you only mention the slow legacy automobile companies (instead of Kia/Hyundia and Byd) makes me think you haven’t done any research on who has the viable battery technology and prowess to take on Tesla. Right now, they are the only real competitors.

I can’t disagree with anything you’re saying, but the reasons for success can be more cultural than technical. Apple is a weird animal – not first, not fastest, not best, not supportive of the tinkerer/ customizer/ modder/ genericist of the PC world pre-2010 — just the company that saw a lifestyle and a target market – overly-indulged hipsters, creatives, and middle-class helicopter parent-families with way too much income and not enough attention to specs, options, and inter-operability – my people. They were fashion and influencer and provided a working ‘eco-system’ – not just an endless array of gadgets and 3rd party peripherals. The profit and margins were enormous and just self-reinforcing – a massive juggernaut of must-have products based on a peridodic showcase by a turtleneck guy bigger than God.

Tesla’s vehicle products don’t particularly appeal to me. The BEV universe does not particularly appeal to me – it requires too much of an entire economic overhaul for what? save the earth? overcome fossil fuel shortages? Couldn’t care less. It’s nice to have options and I look forward to an economy of ‘battery-choice’ – a supplement to an ICE, H2, whatever. Nice to plug in at home or wherever for 50 or 100 or 500 extra miles. And hey – reduce fuel usage and CO2 life-cycle at the same time? why not.

The FSD doesn’t particularly appeal to me – of course, it would be nice to nap or work while on the highway or in traffic — but I am not interested in being some kind of pet that gets transported around – which is why I care so little for transit. Car culture is that of freedom, self-control, and individuality. Add a reliable battery to that SUV, rec vehicle, pick-up truck, performance car, etc., -even 75% of use- and now we’re talking.

I don’t see Tesla as embracing that mindset of choice. Tesla wants to control the look, culture, and choices – in a narrow band of ‘vanilla one model per use’. Maybe that appeals to 50% of rich-worlders who are just looking for a ride for their particular stage of life -and- of course, early adopters – fewer than one would think. I believe that other European and US car companies see that – vehicles are like your clothes or home or career – the You. Choice required.

BYD? Chinese company. A forever-developing country without any identity – are they West? Are they anti-West? Are they Mao? Are they anti-Taiwan? Are they Confucius? Are they ‘whatever it takes to gain influence and attention on the world stage’. Couldn’t care less – they will be a mostly peasant country with vast stretches of capitalist wealth and technology scattered to whatever zones of influence allow it. Who cares about their vast armadas of smaller 2500lb cars? The US and to a lesser degree the EU are the only markets that will really embrace tech, lifestyle, wealth, and opportunity.

I wish Tesla good luck and hope they stay profitable and relevant – but world dominating past 2025 – not a chance.

You would be amazed how much I agree with your viewpoints. I grew up in the oilfields of west Texas and Oklahoma. Still making money on midstream companies and the Permian basin. Reducing CO2 is nice, but it is not an existential problem.

But I can’t close my eyes to what is happening. The battery tech and state of the art auto/truck manufacturing coming out of South Korea and China has surpassed the US and Europe. I don’t like it, but I can’t stop it.

Thank God for Tesla, SpaceX, and the drive/ambition/ego of Elon Musk. He has almost single handedly kept us in the game.

Electrification of the economy is coming whether we like it or not. Within 5-10 years, BEVs will not only be cheaper to power and maintain, but will be cheaper to purchase across all categories/classes. Electricity will be cheaper and more plentiful because of grid storage for wind and solar.

My only worry for the future is the death of morals. Democratic Capitalistic countries only last as long as 20-30% of the population are unselfish and hardworking. Greed, laziness, and lack of trust (by lying and not keeping your word) eventually destroys any society.

Glad I’m not 20 or 30…