Polestar and Lucid Motors are Tesla EV competitors that are getting short of cash.

Lucid Motors had about $4.9 billion in cash and investments at the end of the third quarter of 2023. At the end of the second quarter, Lucid had about $5.5 billion. Lucid raised $3 billion in a June 2023 stock offering led by its majority owner, Saudi Arabia’s Public Investment Fund. Lucid production outlook for 2023 was revised tdown o 8,000 – 8,500 vehicles from prior guidance of more than 10,000 to prudently align with deliveries.

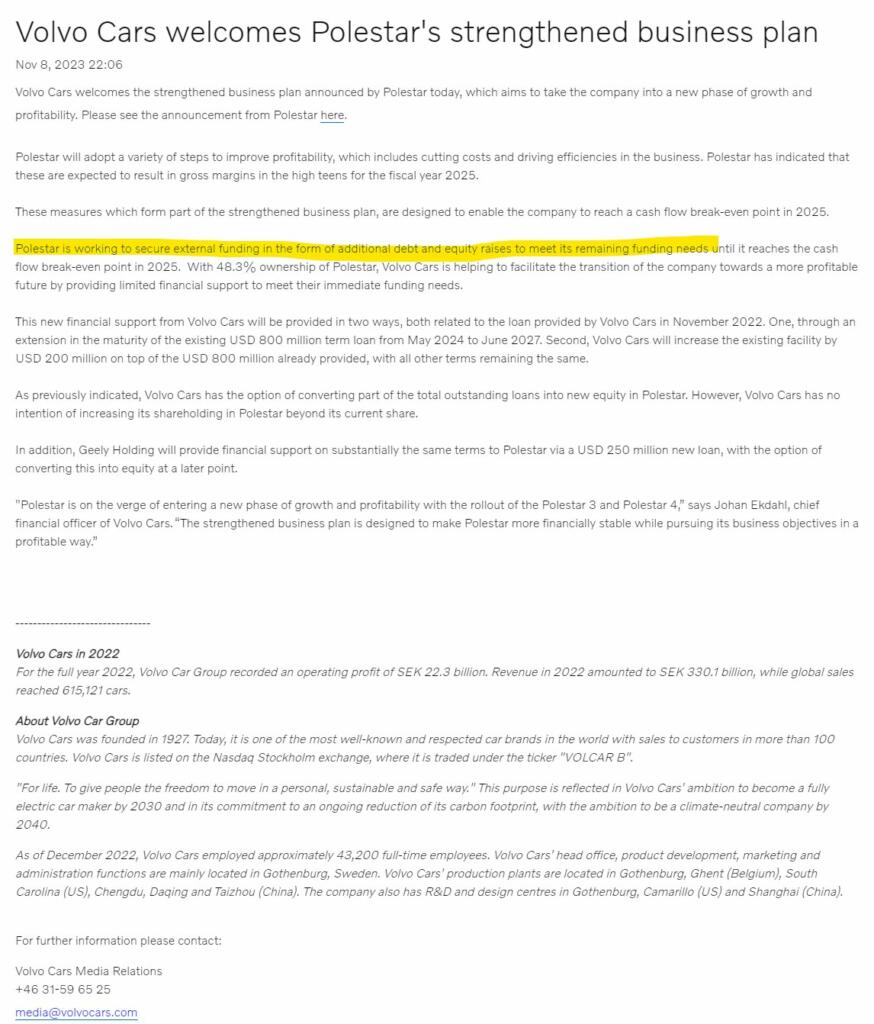

Polestar (Owned by Volvo. Volvo is owned by China’s Geely) will be seeking external funding in the form of additional debt and equity raises. Polestar delivered 27,900 units in the first half of 2023.

BREAKING: Polestar's immediate parent Volvo (owned by Geely) just announced that Polestar will be seeking external funding in the form of additional debt and equity raises.

This is exactly what I predicted in my research. This was unavoidable.

Link to my research note:… pic.twitter.com/jcT7WIoA9e

— AJ (@alojoh) November 8, 2023

🔥🔥🔥INVESTOR WARNING: Polestar (PSNY) will need to raise additional capital beyond the $1bn announced yesterday!

In light of Polestar's recent announcement of a significant $1 billion capital raise in 4Q23 which I had predicted in my prior analysis, I have updated my financial… pic.twitter.com/HMZl1eVj40

— AJ (@alojoh) October 12, 2023

Lucid reports $137.8 million in Q3 revenue, reduces production outlook#TeslaNews

Lucid Motors has reported its third-quarter earnings for a miss on analyst revenue estimates, and the automaker has reduced its 2023 production outlook even further. pic.twitter.com/7UYLGur7bw

— Joe Hansen (@joehansenxx) November 8, 2023

Loss per EV sold (as of end of Q3 2023):

• Lucid: $433,000

• Rivian: $30,600

• Ford: $36,000 pic.twitter.com/IXETKk3L9w— Sawyer Merritt (@SawyerMerritt) November 7, 2023

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

They are still bringing money in. So they are not dying. Why is everyone is supposed to die because he is not Tesla or Elon Musk?

Hmmm… that is a pretty sad profit-and-loss statement, if I don’t say so myself (LUCID). Basically they’re burning a third of a billion dollars in losses … per quarter? That’s preposterous.

How timely this article though.

My lil’ downgraded YouTube feed (downgraded by no longer having much AdSense anti-marketing software defending it) now has all sorts of Lucid-like tele-evangelist advertisements above the line. Endless. $75,000 for a Lucid AIR. $749 a month for a 3 year lease and only $15,000 ‘down payment’ supposedly refunded by the State of California for making the purchase.

Now, fellow Goats, I know full well that we’ve all been through a steep period of Inflation. I ‘feel’ it every dâhmned time I go out to eat, or to the store to pick up nominal ‘old man’ groceries, or the gas station to fill up the truck. Ridiculous. So, maybe the absolute cost — $75,000 — of a fine Chinese made electric vehicle isn’t particularly outrageous.

BUT IT IS.

I’m sorry, but no amount of supple leather interior trim, 5 axis steering wheel positioning, 10 zone comfort controls and a frigging battery that won’t work during commonly encountered sub-zero weather is going to be worth $75,000 to me, or anyone else with a brain. From a company that doesn’t seem able to sell the measly 10,000 cars it made, to a market that’s wholly uninterested in the expense. And not plug-compatible to the № 1 market leader’s ubiquitous fleet of electricity super-chargers. Oh, gimme a break.

This is the E-Car’s quandary. Kind of like what happened in the 1960s and 1970s when there were dozens of different xerographic copier makers — each with their own complex raw copier juices-and-paper-and-toner needs — and the Big Elephant “XEROX” corporation. Xerox introduced nearly trouble free ‘dry’ xerographic copiers, that took ordinary paper, had no noxious fluids or emissions, and required precious little expertise except hitting the Big Rëd Button.

For awhile at least, ‘they won’.

They won because instantly the public ‘got it’ and got rid of their cranky competitor’s xerographic copiers. They made leases that were quite cost effective; they included periodic service calls with the leases, they automatically refilled one’s supplies and they had an 800 number support line that actually answered the phone with people, and usually resolved issues quickly and inexpensively.

E-Cars are in a similar dilemma. There really is — at least in this country — one Big Elephant in the driver’s seat (sorry, couldn’t pass that pun up).

Tesla.

And so, it goes. The also-rans having also ran the race, and positioned behind the 4th or 5th Tesla’s-own runners well … not winning the race. But you could have a spiffy new Lucid for only $750 a month! What-a-deal!

⋅-⋅-⋅ Just saying, ⋅-⋅-⋅

⋅-=≡ GoatGuy ✓ ≡=-⋅

Canaries are dying in the coal mine. That tells you something about Tesla’s future.