Nvidia and other AI related companies have had a surge in profits and share prices. Are we in an AI Bubble or the early stages of the AI transformation? My video has a broader perspective on this. Below is a start at looking at the current details.

There is additional information from the Stanford AI Index 2023. It provides a broad overview of the state of AI. It is published every year in April. This last index was from April 2023.

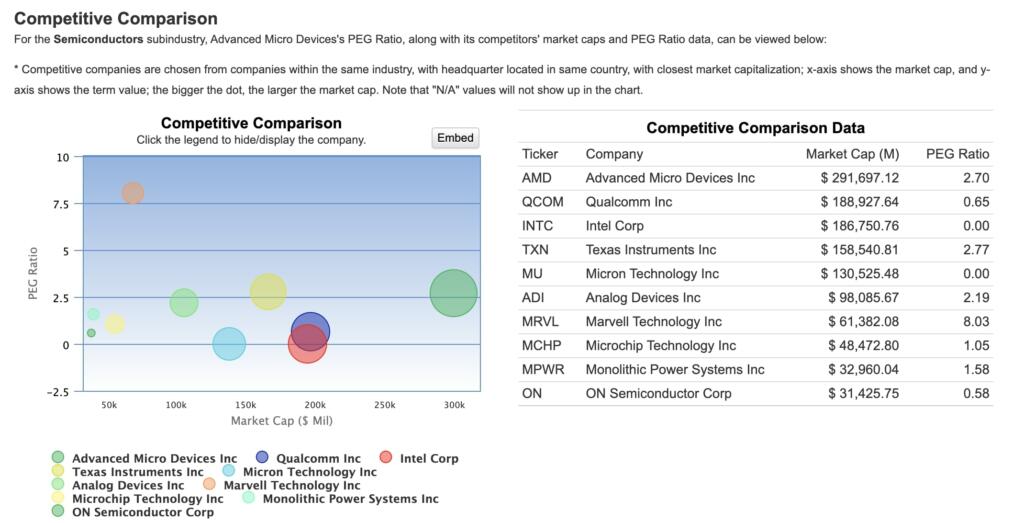

PEG ratios are price earnings and growth. Price and earnings are known values. Growth estimates involve using analyst forecasts. The analysts may or may not be correct. Stock prices would tend to do better if growth performance is better tahn analysts expect.

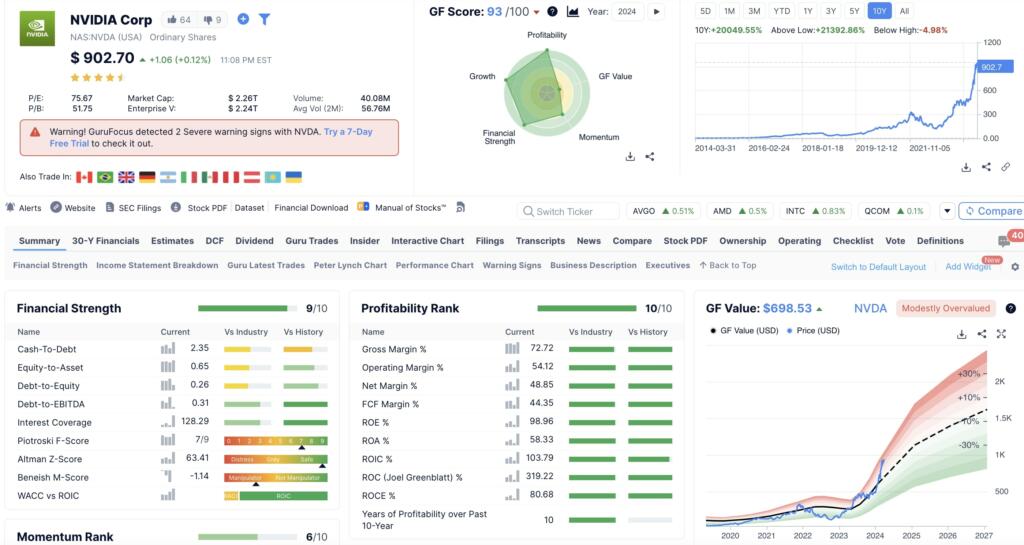

Nvidia Share Price Financials as of Today

Nvidia’s PEG (Price earnings Growth) Ratio is defined as the PE Ratio without NRI divided by the growth ratio. The growth rate is the 5-Year EBITDA growth rate. As of today, NVIDIA’s PE Ratio without NRI is 74.30. NVIDIA’s 5-Year EBITDA growth rate is 45.00%. Therefore, NVIDIA’s PEG Ratio for today is 1.65.

Meta Shares as of Today

Alphabet (GOOGL) has a PEG ratio of 1.21 as of today, based on a PE ratio of 25.47 and a 5-year EBITDA growth rate of 21.10%.

Microsoft

Microsoft’s (MSFT) PEG ratio is 2.06, based on its 5-year EBITDA growth rate of 18.50%.

Amazon

As of March 25, 2024, Amazon.com (AMZN) has a PEG ratio of 1.56. The PEG ratio is the price-earnings-to-growth ratio, and a good PEG ratio is generally lower than 1.0.

AMD Shares as of Today

AMD PEG Ratio is defined as the PE Ratio without NRI divided by the growth ratio. The growth rate we use is the 5-Year EBITDA growth rate. As of today, Advanced Micro Devices’s PE Ratio without NRI is 125.34. Advanced Micro Devices’s 5-Year EBITDA growth rate is 46.50%. Therefore, Advanced Micro Devices’s PEG Ratio for today is 2.70.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

An old boardgame called Acquire (originally issued by Avalon Hill) is popular in my family. You place tiles on a grid and when two or more are adjacent, the player placing the last one may start a new company, get some stock, buy some more, etc. Eventually a tile is placed between two companies and the larger one eats the smaller one (really huge ones are immune to being eaten). Early in the game you want the companies you have majority in to get eaten, as you get lots of money (and perhaps some stock in the company eating yours) and can then go on to invest your new found money elsewhere. It is your only source of income. But late in the game there are only 2 or 3 huge companies left that eventually consume the entire playable portion of the board, and they are extremely expensive. You really need a big chunk of them, preferably majority, to win. Obviously, you had to start working on that fairly early.

Some stocks today remind me of that. If there are less than a dozen really big stocks owning most of the world in a few years (the really big winners in AI/AGI), you want to be heavily invested in them. But which ones are they? Bubble or not, you need to get in as early as possible and stay there. If you can figure out which ones are going to be the big winners.

It might provide a useful insight to roughly calculate how much processing will be required to replace all white collar workers with LLM based agents, then determine how long until we have enough processing power to actually do that for the developed world, then for whole planet.

This seems relevant to the potential for a bubble – either in processing power (if not a lot more is needed, NVidia stock crashes) or application companies (if there’s not enough processing power to implement all the labor-saving schemes AI companies are aiming for).

And then do the same for robots to replace physical labor – maybe assuming 10x amount of white collar processing. Probably can come up with a better guestimate than that, but robots may also get specialized pre-processors for visual input that are cheaper than doing everything directly with AI. (We might find that once AI replaces all mental work, the best use for humans, since we have to feed people anyhow, is to have them do nearly mindless physical labor, hauling stuff around at the direction of an AI – as in Martin Ford’s speculations – though that was a transitional stage in his Rise of the Robots.)

Yesterday a new AI Chatbot for NYC released to the public, turned out to give advice to users including small businesses that would result in them breaking the law: https://www.thecity.nyc/2024/03/29/ai-chat-false-information-small-business/

It advised landlords NOT to rent to tenants with section 8 vouchers, when it’s actually illegal not to.

It said restaurant management could retain part of worker’s tips. That’s illegal too.

I asked it myself if it had access to the internet. It said it did, but when I fed it links to my own development project, it couldn’t access it, and it had no idea what the “RiverArch” was, even with a link to my video which has been seen >10,000 times: https://bit.ly/Riverarch

OK, this AI is particularly bad, but there have been lots of more robust AIs that keep saying wrong things, including an infamous example of a lawyer relying on ChatGPT for a legal write-up in court, based on cases that never existed. The lawyer faced a heavy fine and could have been disbarred for lying to the court.

Imagine this level of mistake by an AI surgeon, or an AI driven semi-tractor truck on a crowded highway.

That’s where the bubble will be pricked. No one has a clear idea how to make AI more reliable, other than on a case-by-case basis with lots of human correction, and that doesn’t scale. The problem may even get WORSE with more data, which will include more unreliable data too. When this problem becomes well known and it becomes clear it’s not easily fixed, if it can be fixed at all, the stocks will crash.

This is exactly my thinking. Unless you already know what you’re talking about on a certain topic, trying to get a lot of accurate information from these LLMs without giving it accuracy to work from is like herding cats.

I think there will be significant pullbacks in stocks related to A.I. [of this type] unless ways are found to quickly make them incredibly accurate and reliable in applicable workplaces. For example, zero mistakes in court documents.

Ask it to do a picture of Napoleon III. I got a picture of someone looking most totally unlike the real Emperor of the French Napoleon III. Oh, the AI DID get the skin color right for once.

But no famous moustache!

If it’s a bubble which stock has blown up?

I still think about the .com bubble and how that web van went bankrupt after buying a vehicle fleet…. lol. In 2024 people are so lazy they have McDonald’s and groceries delivered.. mmmm. Cold fries /s

When there is discussion of a bubble, they are talking about prices inflating to levels where there is a significant crash. AI stocks may or may not get ahead of fundamentals. Any slight disappoinment can cause a substantial pullback. I provided the PEG ratios for some of the stocks.

Do you know the PEG Ratio for the stock “PALANTIR”?

I just purchased 100 shares. The fact that they have government contracts

along with their other services.

Thank you for your insight.

Palantir Technologies Inc. (PLTR) has a PEG ratio of 1.90 as of March 26, 2024. This is based on the company’s price-to-earnings (TTM) of 25.71, price-to-book (mrq) of 15.85, and enterprise value-to-revenue of 23.20