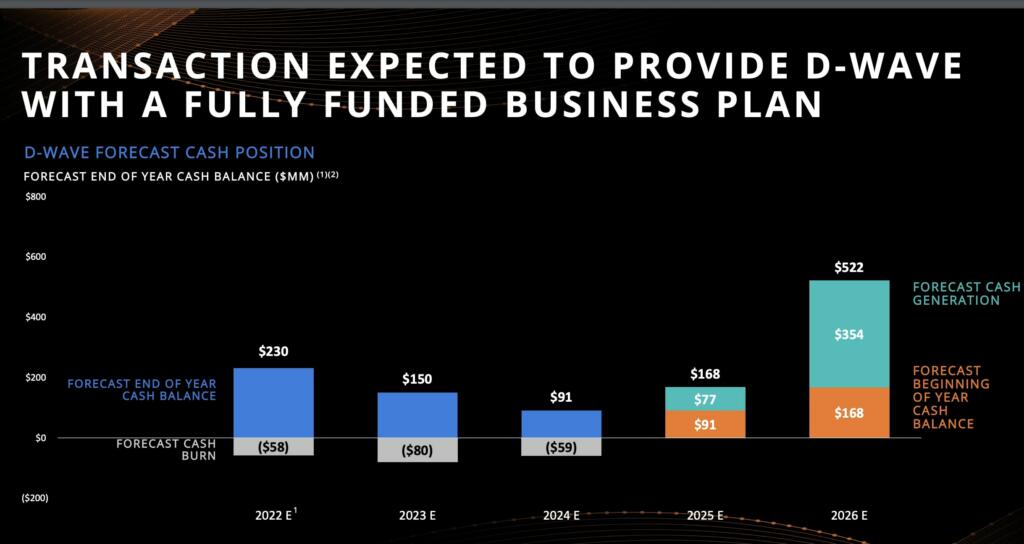

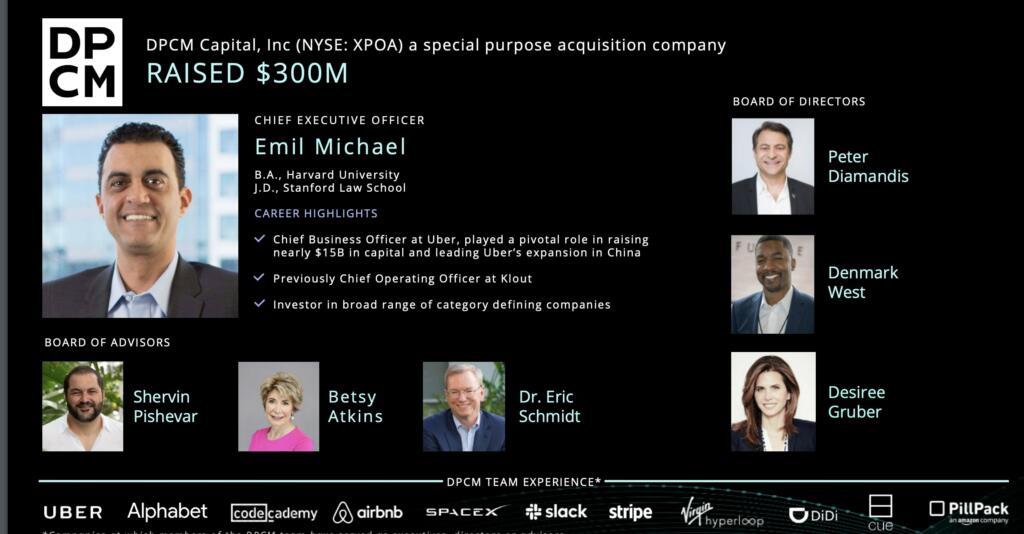

D-Wave Systems was trying to raise about $300 million from a SPAC.

D-Wave was hoping the completion of the merger with DPCM Capital would grant it access to a trust account worth $300 million, assuming that there were no redemptions by shareholders, but the company disclosed in a recent filing with US regulators that the SPAC’s shareholders had in fact exercised those rights and redeemed $291 million worth of shares.

D-Wave shares are trading about 40 cents.

At the point of the SPAC deal, D-Wave had a $1.6 billion valuation. The market setbacks likely have this in the $200-400 million range. D-Wave will need tight execution to get to profitability per their SPAC fundraising plans.

D-Wave has brought five generations of adiabatic quantum computers to market and in June launched an experimental prototype of its sixth-generation machine called Advantage2.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.