Tesla had a big beat on Q2, 2023 deliveries with 466,140 cars delivered and 479,700 car produced.

I think Tesla will trend around 90% of actual production capacity (production being demonstrated sustained over weeks).

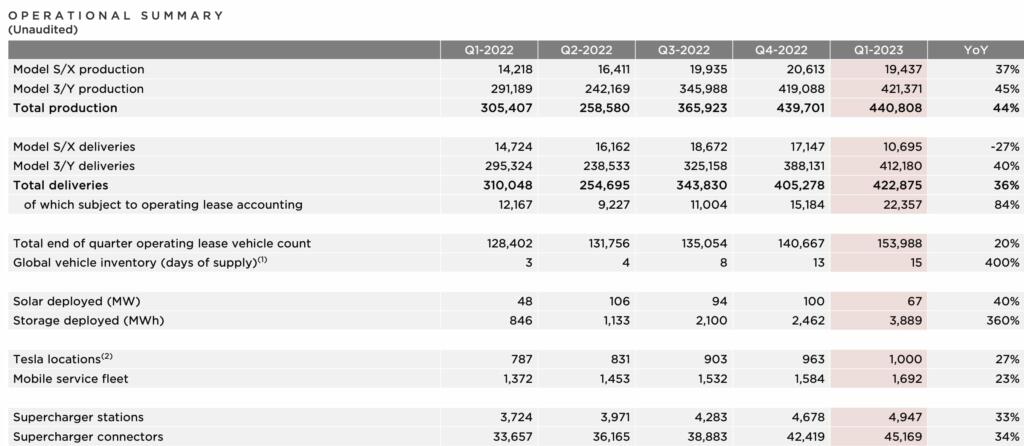

In Q1 2023, Tesla delivered 423k cars and produced 440k cars. This was about 89% of real peak production capacity. Tesla Shanghai has shown three months of 88,000 cars produced. This would be 264k. Fremont can make 150k cars per quarter (although the Tesla stated Fremont capacity is 650k per year. Tesla S/X are at 80k per year). Berlin and Austin had reached about 40k per quarter in Q1. IF Tesla could produce at full capacity in Q1 this would have been 494k cars.

Tesla Shanghai has shown three months of 88,000 cars produced. This would be 264k. There was a few days of shutdown in China. Fremont can make 150k cars per quarter (although the Tesla stated Fremont capacity is 650k per year. Tesla S/X are at 80k per year). Berlin and Austin each could produce 65k in Q2. IF Tesla could produce at full real potential capacity in Q2 this would have been 544k cars. Tesla produced 489k cars. This was 92%% of 530k cars.

Tesla has increased production capability to 5k per week in Texas and 5k per week in Berlin. I had expected a continued production capacity ramp in q2. This has not happened yet. However, Tesla will shutdown Texas Model Y production line for 5 days in early July to increase production capacity. The average quarterly production should be 7k per week in Texas and 6k per week in Berlin. The Texas shutdown and increase in production will see about 84k cars potentially from Texas and 72k from Berlin in Q2. China potential would be 264k and Fremont 150k. This would be 570k cars with real peak production capacity. Tesla should produce 90% of that level or 513k cars in Q2. 92% would be 524k cars. If Berlin gets expanded or improvements were also made to the China lines, this could increase.

Q4 each should be at 130k cars each for Berlin and Austin. Q4 peak potential would be 674k. Q4 at 90% of peak real production would be 607k. If Berlin and Austin only had 100k of potential each, then Q4 peak potential would be 614k and 90 would be 552k.

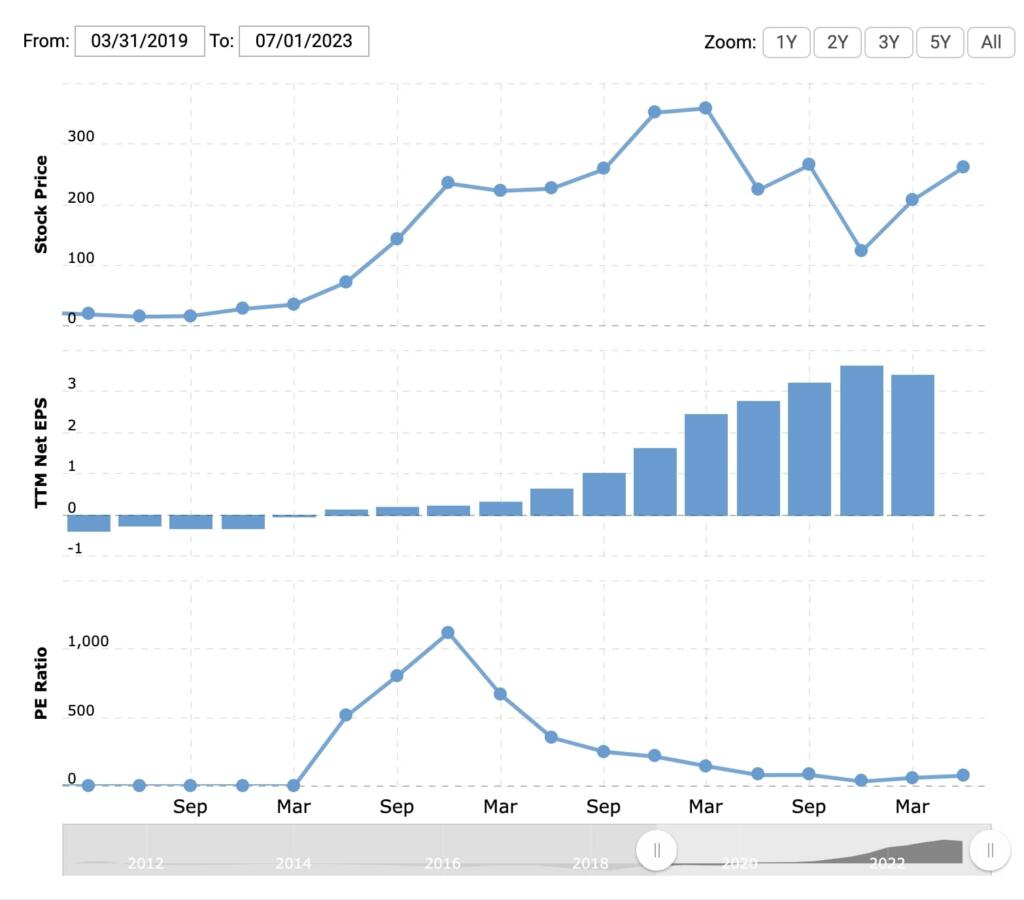

Randy Kirk also ran some Tesla numbers with about 1.95 million cars and increased energy. This would get to about $5 EPS for 2023.

Tesla has had a wide range of price earnings multiples. Tesla PE was as low as 30 in Q1 and is back to about 80 now and was at 146 to 210 at the end of 2021 and beginning of 2022. IF Tesla has 50% growth and adds in an energy business with 20-30% margin and the energy business has 200% growth for the next several years then PE in the 50-100 range would be reasonable for Tesla most of the time. Macro economic and stock market swings could send Tesla to a wider PE range of 30 to 150 PE.

I think the high EPS is very doable for Tesla. It involves very good execution. Car production going well, good Cybertruck ramp, Semi and getting 4680s properly on track and scaling. Megapack factories in Lathrop, Shanghai and beyond should get built and scaled.

The 100PE would be with solid 200% growth with Megapacks and Energy and with FSD coming off best in early 2024. This would mean full revenue recognition of all FSD revenue and increased attachment rates. There would be free monthly trials of FSD. There would also be bundling of FSD with Tesla insurance. This would lead to robotaxi and robotrucks in the 2025-2026 timeframe.

Tesla AI Dojo as a service could also become significant in 2025 as additional revenue and as an AI training service.

Teslabot and the full robotaxi scenario would create performance levels on EPS beyond the high EPS which is mainly cars, energy and non-beta FSD.

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

You could send them to Ukraine and drive them remotely as mine clearance or artillery decoys. Much cheaper than armoured military vehicles.

Musk wouldn’t do that though, he’s too deep in Putin’s pocket. Funny how he started talking about shutting off Starlink to Ukraine, or Ukraine giving territory to Russia shortly after the visit where he told them he wouldn’t be sharing Falcon tech with them. They definitely got some kompromat on him after that event.

IMO Musk spends too much time focusing on Twitter and other companies develop slower because of that. I am not saying he hasn’t done a ton a lot of great things, I just see possibility for faster improvement.

Cybertruck and Semi are still not mass produced after all those years. They have 2 very good selling models(3, Y), S and X are just old and numbers are low.

There is a lot of potential in battery business, but they still hadn’t done meaningful ramp.

I question myself why are they delaying Cybertruck over and over again, they have the resources. Most likely cause are batteries. It seems it is harder to mass produce them than they anticipated and dry-electrode process is giving them problems. Hope they fix it. Batteries are the key tech here, they should put more effort into them.

Honestly speeding Cybertruck or battery development doesn’t need Musk’s intervention. I said this before and I will say it again: if Saint Musk needs to go down to the assembly line and lay his hands on it to make things work then Tesla is hiring idiots.

Yeah it does honestly if they want to progress faster. Because of him, his good decisions Tesla is where it is. You have plenty good people at other companies and where are they compared to Tesla?

Anyway waste of my time for troll.

Tesla share in market last year was down again to 58% despite the price cuts due to a bigger selection of models from other makers. I am so glad as the market is maturing in a healthy manner.