The surge in its production of shale gas has made the United States the largest natural gas producer in the world, and it is expected to join the legion of liquefied natural gas exporters and even become a net

exporter of natural gas later this decade (U.S. EIA 2014). With surging supply and weak demand, natural gas prices in the United States have fallen sharply in recent years and are effectively decoupled from those in the rest of the world. In particular, prices in Asia and the European Union have risen, partly because of the indexation of imported natural gas prices to oil prices. So far, energy users in the United States have been the main beneficiaries of the energy price declines that have resulted from the U.S. shale revolution. However, that revolution has helped to stabilize international energy prices, including by freeing global energy supply for European and Asian markets, thus offsetting some of the shortages attributable to geopolitical disruptions. Also, the U.S. shale boom has displaced coal from the United States to Europe, lowering energy

costs in the latter.

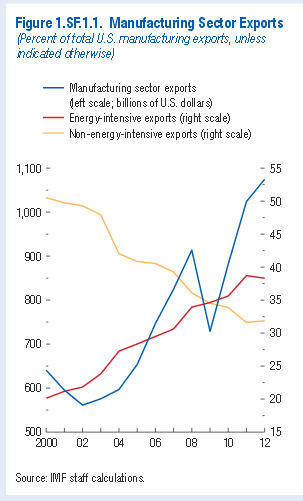

Cheap natural gas has delivered a significant boost to US manufacturing exports, the International Monetary Fund has found. Advances in shale rock drilling have led to a sharp rebound in US gas production, driving prices in the US to a steep discount to markets in Europe and Asia. US gas sells for $4 per million British thermal units, compared with $10 in Europe and close to $18 in Asia.

The natural price gap has led to a 6 per cent average increase in US manufactured product exports.

The IMF have a 24 page working paper The U.S. Manufacturing Recovery: Uptick or Renaissance?

U.S. fossil fuel imports decreased to $225 billion (1.3 percent of GDP) in 2013 from $412 billion (2.8 percent of GDP) in 2008.

“A 10% reduction in the relative price of natural gas in the United States is found to lead to an improvement in U.S. industrial production relative to that of the Euro area of roughly 0.7% after one and a half years,” IMF said.

Input – Output (I – O) tables suggest that a number of manufacturing sectors would profit from lower energy costs. Notably , a 10 percent decrease in the cost of energy implies a 10 percent increase in the gross operating surplus of the Primary Metals sector, a 6 percent increase in Printing and Related Activities , a 5 percent increase in Paper Products , and a 4 percent increase in Chemical Products .

The increasing U.S. production of oil and gas through unconventional extraction techniques can result in positive spillovers for manufacturing. In its Annual Energy Outlook for 2013, the U.S. Energy Information Agency projects that total domestic production of oil and gas could increase by 10 – 15 percent through t he end of the decade, with upside risk scenarios pointing to increases of 30 – 50 percent. These scenarios factor in decreases in conventional production as well as significant increases of shale gas and tight oil production volumes. In this connection, tight oil is projected to increase by 40 – 120 percent through 2020, while the growth of shale gas production is projected to be in the 35 – 60 percent range. Higher production will necessitate higher inputs, including from the manufacturing sector. However, basic analysis using I – O accounts suggest that the demand ‘pull’ from the energy boom to manufacturing would be limited. The additional production in the oil and gas industry brought about by the energy boom would result in a positive contribution to manufacturing growth of around 0.1 – 0.3 pp per year through the end of the decade.

If you liked this article, please give it a quick review on ycombinator or StumbleUpon. Thanks

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.