I am part of the Tesla VPP program in Northern California. There are now about 2800 households that are part of the VPP. PGE is having its second VPP event in about two weeks.

Those with Tesla Solar Power and Tesla Powerwalls who have opted into Tesla’s Virtual Power Plant program get $2 per kwh when their power utility uses the Tesla Virtual Power plant.

Matt Smith thought my assumption of 1 emergency per month was too aggressive. However, this now looks like it may not be too aggressive. Two events per month would be $100-140 per customer per month and would mean $1000-1800 per year.

I have been saving about $300 per month on my electrical bill with my Tesla solar and power walls stationary battery storage. Net metering (running power back to the grid) will get paid in April and is currently tracking to about $500 per year.

My solar and power walls could make me $3000-4000 per year from electrical bill savings, $500 from net metering and $1000-1500 per year from VPP. This will be about $4500 to 6000 per year. My solar and power walls should pay for themselves in 5-6 years.

The history shows that for just about every year but 2020, these types of emergencies and warnings have been pretty infrequent. However, you usually are not wrong by assuming PGE is more incompetent than you expected.

The Tesla VPP particular program is more expensive than most grids could/should offer, so scaling these economics nationwide is definitely a problematic assumption. Matt Smith ran through some detailed math on this a while ago in the video. He assumed a house with solar and Powerwalls could generate ~$400 / year, which would be split between Tesla and the customer.

There were 2408 fleet homes in the Northern California PG&E Tesla Virtual Power Plant (VPP) two weeks ago and there are now 2800.

This was about $50 generated from the event.

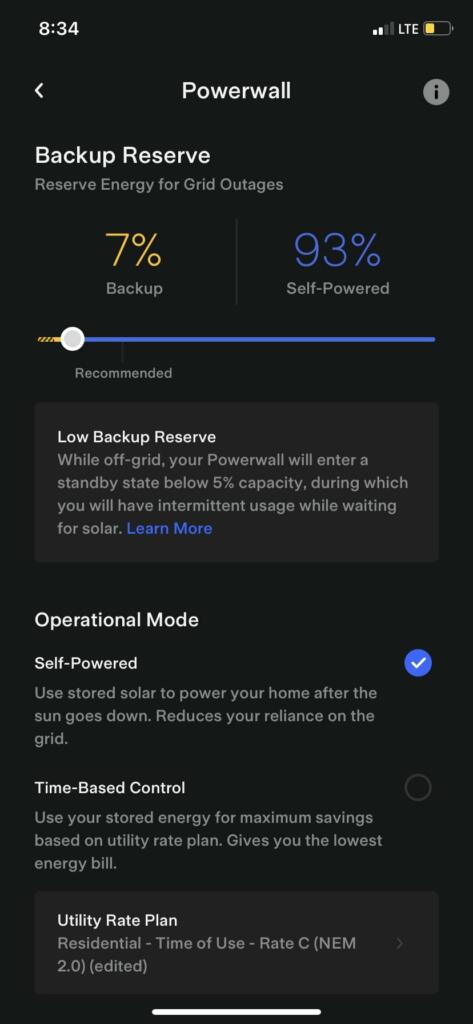

The 2800 homes can generate a peak of about 18-24 MW of power. This depends upon the number of powerwalls at each home and how much backup power they reserved. Two Powerwall put out about 10 KW of power or 10 kwh per hour.

The event lasted from 5am to 9pm that day. This VPP was discharging for PG&E from 6pm to 9pm. PG&E could be supplied about 50 MWh of power. This meant 50000 kwh or about $100,000 paid to VPP supplier homes. Tesla could eventually take some of these payments. Tesla is likely getting paid for other energy management services.

CAISO study calculates a massive price differential to ensure local reliability in the face of impending plant closures: $299 million for a 262-megawatt combustion turbine, $805 million for a combination of distributed and front-of-the-meter storage.

A $800 million natural gas peaker plant would be kept online even if it was not used. The VPP at 18 MW would be about 8% of a full natural gas peaker plant. However, there may not be the full need for the entire output of the peaker plant. PG&E does not pay the $1000-2700 per kw to support the construction of the peaker plant. PG&E does not pay for the natural gas power when the peaker plant is used. The Tesla solar and powerwalls are all paid and installed by the homeowners. This likely cost a collective $90-130 million. If the program expands to 32000 homes then they would be able to mostly offset a 270 MW peaker plant. It would cost the homeowners $1.45B-2B to install. The homeowners would be doing it anyway. They get repaid for the energy shortage events.

Peaker plants run an average of 2.8 hours every time it starts up and has a capacity factor of 2-10 percent. Most of the plants are 40-80 MW in size. 40 MW for 2% capacity factor would be 174 hours and 6,960,000 KWH. 80 MW for 10% capacity factor would be 868 hours and about 70,000,000 kWH.

If the VPP starts to fully replace a full peaker plant that would mean one to five 3-hour events every week. Annual VPP costs assuming $2 for kwh for homeowners and $2 per kwh for Tesla would be $14M to $140M per year.

About 12 or 15% of the peaker plants are used less than 1% per year or for one event every three weeks. This would mean those plants still have the same construction costs. They are only used for 0.5% of the year. A 40 MW or 80MW plant would be used for 45 hours. This would be $4-8 million per year. It would save the $150-300M construction cost. Annual operating costs would be similar. It would likely make sense for a utility to use a virtual power plant for peak plant usage at less than 1% and perhaps even 2-3% capacity levels.

Across California, nearly 80 gas-fired power plants help meet statewide peak electric demand. These plants include 65 combustion turbines designed to ramp quickly to meet peak demand, and over ten aging steam and combined cycle turbines now used infrequently to meet peak needs.

PG&E supplies about one-third of the power for California.

In the last hour of the event, more homes were dropping out because they had hit the minimum reserve backup power level or their Powerwalls were tapped out.

At the 0.2% usage level or 18 hours per year then the VPP participants would likely get a positive return $420 per year.

At the 0.5% usage level or 42 hours per year then the VPP participants would likely get a positive return $900 per year.

At the 1% usage level or 87 hours per year then the VPP participants would likely get a positive return $1800 per year.

If the VPP program was expanded to five times the total population of California then it would be a $1 billion per year profit for Tesla.

A homeowner would $420 per year per homeowner if VPP is used only one 3-hour event every other month.

SOURCES- Tesla, PSEHealthyenergy

Written by Brian Wang, Nextbigfuture.com

Brian Wang is a Futurist Thought Leader and a popular Science blogger with 1 million readers per month. His blog Nextbigfuture.com is ranked #1 Science News Blog. It covers many disruptive technology and trends including Space, Robotics, Artificial Intelligence, Medicine, Anti-aging Biotechnology, and Nanotechnology.

Known for identifying cutting edge technologies, he is currently a Co-Founder of a startup and fundraiser for high potential early-stage companies. He is the Head of Research for Allocations for deep technology investments and an Angel Investor at Space Angels.

A frequent speaker at corporations, he has been a TEDx speaker, a Singularity University speaker and guest at numerous interviews for radio and podcasts. He is open to public speaking and advising engagements.

Thanks combinatorics

The Vehicle to Grid potential is already orders of magnitude larger. Most new EVs have the hardware to participate, would require only software updates.

The barriers are the J1772 EVSE standard not being designed for reverse power flow, and the need for an isolation switch just like solar systems have.

apparently there is also a VPP operating in japan now, on an island to backstop the island’s power, particular when it’s down due to typhoon damage. The island power utility is apparently partially subsidizing powerwall deployment (and subsidizing some solar too though not necessarily Tesla roof solar tiles).

https://www.tesla.com/customer-stories/miyakojima-vpp